The first few weeks of August have brought a return to market volatility. We’ve sent out several notes on our thinking over the last few weeks, and in the initial article below, we bring you up to speed on our latest thinking regarding the underlying causes of the volatility as well as what it implies for future portfolio changes.

One silver lining to the recent economic slowdown is the lower interest rates we are seeing across the board. This includes mortgage rates, and in the Tip of the Month, we provide some suggestions to those who might be considering refinancing. Finally, whenever sharp economic difficulties arise, interest in gold peaks and this time is no exception. In the Question of the Month below, we examine why investing in gold can be a challenging proposition.

As always, feel free to forward this newsletter on to friends and family that might find it useful, and don’t hesitate to contact us if you have any questions.

Best regards,

Micah Porter, CFA, CFP®

An Update on Recent Economic Challenges and Market Volatility

Micah Porter, CFA, CFP®

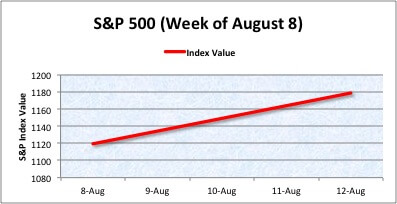

If you didn’t catch much news last week and saw the chart just below, you

Volatility spiked last week to an extent we haven’t seen since 2009, with market moves in excess of 4% the norm for the week. While the good news is that the markets ended the week slightly higher than they began, it’s still worth exploring the causes behind the volatility and what they might presage for the coming months.

It can be difficult to pin down the cause of market drivers, but last week’s primary movers were likely concerns about the European debt crisis coupled with weak economic data, particularly in the U.S. The issue in Europe has been ongoing, but when that was coupled with revisions to U.S. GDP data that showed the downturn was far worse than originally thought, and the recent recovery has been weaker, the markets moved decidedly lower.

The European Central Bank has moved to support Italy and Spain by buying their bonds, and that has bought some respite in those markets. However, at some point political leaders will have to weigh in if the continent is to ultimately contain the crisis. As for the U.S., although the recovery may well give way to recession, there has been some positive economic data including retail sales that continue to hold up quite well and decreasing initial jobless claims. Further, the Fed’s recent announcement regarding maintaining low interest rates through 2013 should provide a tail wind to both the economy and the markets.

So, last week’s volatility was likely both driven by real underlying economic concerns and an overreaction on the part of many market participants. Yes, the chance of a recession is higher than it was, but no, the data wasn’t indicative of a sea change in expectations. As I outlined in my most recent note, if future volatility drives the markets sharply down again, we’ll likely use the opportunity to add selectively to equity stakes as such sharp drops often lead to bargains.

Financial Planning Tip – Refinancing Your Mortgage

Micah Porter, CFA, CFP®

Although it can be difficult to remember in the face of constant media coverage about the difficulties facing the economy, such a tepid recovery does offer a few upsides. Given the recent softness in economic data, the Fed recently stated interest rates would remain low through 2013. As a result, mortgage rates across the board dropped as well. 30 year rates hit their lows for the year, and 15 year mortgages neared all-time lows.

- If you are carrying a fixed mortgage, now might be a good time to consider refinancing. If you decide to do so, keep the following points in mind:

- If you’re moving from one mortgage of the same type to another – 30 year fixed to 30 year fixed, for example – typically, it will only pay to do so if the interest rate of the new loan is at least one percent lower than the existing loan.

- Try to stay below the jumbo rate if possible, as it is higher than the interest rate on conventional loans. One obvious way to do this is to put more cash down, but another method for remaining below the jumbo limit is to split your mortgage into a first and second mortgage.

- The shorter the mortgage term, the lower the interest rate, so it might be possible for you to move to a shorter term mortgage without a substantial increase in your payments. Moving from a 30 year mortgage to a 15 year mortgage, for example, means that you not only pay a lower interest rate, but you pay less interest because the loan is paid off sooner as well.

- Even if you don’t think you would qualify to refinance because your property has dropped in value, it’s worth your time to check into the possibility. There are still government programs in effect that will backstop your loan, which means lenders will make loans with less equity than would normally be the case.

Although the Fed indicated interest rates would remain low through 2013, there’s no guarantee that mortgage rates will remain at their current lows. Thus, if you think refinancing might make sense for you, we’d advise checking into it in the near future.

Question of the Month – Why Don’t More Advisors Recommend Gold?

Micah Porter, CFA, CFP®

Whenever we hit tough sledding economically, gold rises in popularity as an investment. The most recent downturn was – and is – no exception, as ads for buying gold are everywhere and stores that buy gold have sprung up overnight. Gold is the ultimate bunker investment, and it’s where some investors turn when concerns rise about the global economy. So why don’t more advisors recommend gold?

The primary reason is that over the long run, returns of gold have not been great. Even though gold prices can rise sharply during economic turmoil, they can decline just as sharply. We took a look at the returns of gold for rolling 30 year periods beginning in 1929 and compared those returns to that of a portfolio invested equally in both stocks and bonds. The end results were eye opening, as the balanced portfolio bested gold’s return 84% of the time. Furthermore, the average return of the balanced portfolio over the 30 years was 1230% versus 461% for gold.

For those who are apt to choose a timing approach to investing in gold, it’s useful to take a look at how quickly gold prices fell in 1980, which was the last time we saw a large run-

For a substitute to gold, understand why you were considering gold in the first place. If it was a question of safety, U.S. Treasuries and very high grade corporate bonds can provide that safety. For inflation protection, Treasury Inflation Protected Securities are one option, as are stocks and real estate. Finally, if you’re seeking diversification, a broader basket of commodities – including gold – can offer a counterweight to the market although in times of extreme economic stress, such an investment is likely to decline in value as well.

All of the foregoing isn’t to say that gold has no place in any portfolio, as it can be a useful investment. However, it’s worth remembering that there are both downsides and challenges to investing that the goldbugs generally fail to mention.