My wife and I dated for nearly 9 years before getting married. We are both naturally cautious, but one of the things that weighed on both our minds was that both of our parents were divorced. We witnessed first hand how difficult divorce can be, and between our personal experience and the oft-quoted statistic that nearly half of marriages end in divorce, it is no wonder we proceeded cautiously.

Fast forward nearly 8 years, and we’re still happily married. We expected that or we wouldn’t have gotten married, but what we do find surprising – assuming divorce is as common as it is purported to be – is that very few of our friends have gotten divorced either. Even more eye opening is that of all the couples with whom I’ve worked over the last dozen years, none have gotten divorced. It turns out that having a strong financial foundation is one of the keys to maintaining a strong marriage.

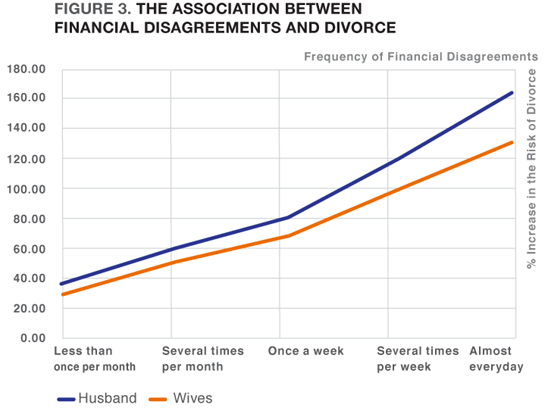

There have been numerous studies that show an indirect link between wealth or income and likelihood of divorce, but a study by Professor Jeffrey Dew addresses the issue most directly. Dew’s research showed that for married couples, there was a direct relationship between the frequency of financial disagreements and divorce. As the chart below shows, the relationship is linear, but once disagreements arise weekly or even more frequently, the risk of divorce increases even more quickly.

The study also showed that among all the things couples typically fight about, money disagreements were the best predictors of whether or not a couple would get divorced.

Dr. Dew examined a number of other issues in his study, including the impact of consumer debt and the amount of financial assets the couple had on the likelihood of divorce. In each case, the net result was the better the financial picture, the less likely the couple was to get divorced. The study’s findings dovetail nicely with other studies that examined characteristics such as educational attainment and age at which one was married. In those studies, higher educational attainment and later marriage were associated with lower divorce rates and both tend to be associated with greater financial means.

The takeaway from Dew’s study (and other, related studies) is that affluence helps decrease the likelihood of financial disagreements leading to divorce. Still, even if you consider yourself affluent, if you find yourself in frequent disagreement with your partner over financial issues, take a step back and try to figure out why. A few high level issues to consider are:

Goals – are both of you in agreement on what you want to purchase and how much is enough? Few of us have sufficient financial resources to avoid having to make choices on what we can afford to purchase, so agreeing upon those choices is key in avoiding disagreement.

How Much Risk to Take – a fundamental axiom in investing is that the high the return one wants, the greater the risk required. If one partner is extremely loss averse while another is aggressive, that can lead to problems, particularly if we experience another sharp downturn along the lines of 2008/2009.

Financial Control – money is power, both in the wider world and within the context of relationships. Unfortunately, if one spouse – usually the high income earner – uses money to unilaterally assert control in the relationship, it can lead to a great deal of disagreement. We find that couples that agree on spending goals tend to fare much better, particularly if they are able to achieve those goals.

For most of our clients, it’s not a question of having sufficient means to accomplish their goals, but rather working together to define those goals and having a framework and tools to achieve the goals. Once the foundation is in place for financial success, the foundation for the relationship is strengthened and clients can focus on what they want to achieve in their lives.