When I first considered becoming a financial advisor, I assumed financial analysis would be at the heart of financial planning. A rigorous mathematical framework for a plan and incisive securities analysis would be the tools that would inevitably lead clients to personal financial success. The problem with that belief was, it overlooked two crucial issues that crop up in carrying out a plan – cognitive biases and establishing good financial habits.

Cognitive biases are flaws in our reasoning that flow from mental shortcuts we all use, and I’ve written about them several times in previous blog posts here. In this post, I want to focus on habits, and more specifically on The Power of Habit by Charles Duhigg. If you have read much at all about personal finance, you’ve run across a list of good financial habits like pay yourself first or track your spending. Unfortunately, there is almost never any follow-up information on how to make something a habit, and that is where The Power of Habit comes in.

In The Power of Habit, Duhigg combines a summary of scientific research with real-life examples to explain why habits form and how they can be changed. He splits the book into three sections covering the habits of individuals, successful organizations and societies respectively. The crux of the book is the habit loop.

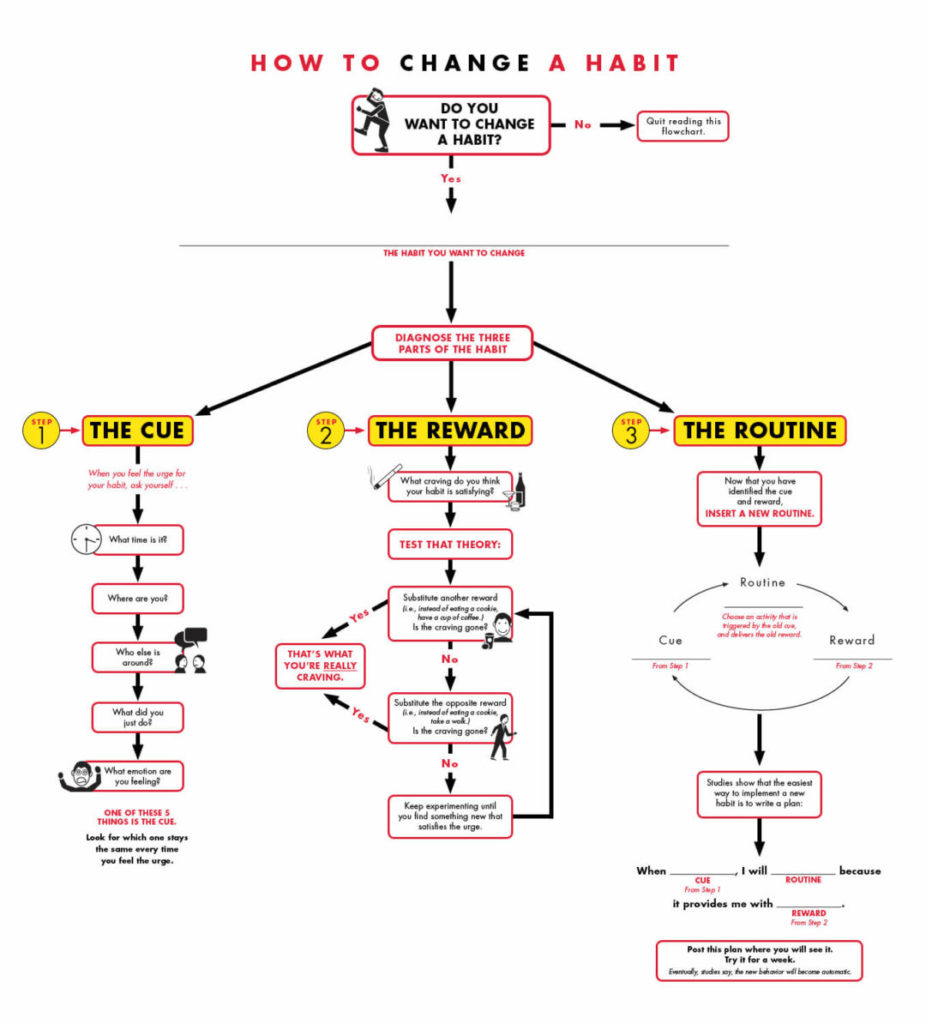

The habit loop begins with a cue, which is anything that triggers a habit. The cue can be a variety of things – a person, a preceding action, a location, a time of day, or an emotion. The cue triggers the routine, which is the behavior you want to change, and what draws us to the behavior is the reward. Getting a soft drink every afternoon provides a boost from caffeine and sugar, while compulsive shopping offers a rush with each purchase. Bad habits are habits for which the short-term reward is offset by the longer-term negative impact. Duhigg explains how to change those habits using the habit loop.

The flow chart below walks through the steps behind habit change. The first step is determining what the habit is you would like to change. Once you’ve done that, you can then begin to deconstruct the habit by finding the cue for the habit, the reward the habit provides and the routine it follows.

Research has shown that simply abandoning habits is hard, but it is easier to substitute a new habit for an old one. The key is that the new habit – which is triggered by the same cue as the old habit – should offer the same reward as the old habit. Returning to the soft drink example, taking a walk in the afternoon when you crave a soft drink might provide the same boost as a soft drink and could work as a substitute. Finding a new habit that offers the same reward can involve trial and error, but once you’ve successfully found a replacement habit, sticking with it for a period of time will cause the new habit to become automatic. You can use the habit loop to form entirely new habits as well by identifying cue, reward and process.

Even when new habits are successfully established, with enough stress, the replacement habit can give way to the old habit. Duhigg recommends joining a group or seeking outside support to help keep you on track. In a financial context, an advisor can provide this support while in other contexts, a spouse, a friend or a support group can be helpful. The important thing is to maintain the habit, as the longer it is maintained, the more entrenched it becomes.

The Power of Habit is an entertaining read if you are considering changing existing habits or establishing new ones. The combination of a defined process, research and real-world examples provides both the how-to and the motivation you need to make your habits work for you.

Micah Porter is a CFP® based in Atlanta (Decatur) Georgia. For more information please contact us.