I’ve begun reviewing what happens in market downturns in client meetings. It isn’t because I believe a bear market is just around the corner, but rather because it has been nearly 10 years since the last one. And while market expansions don’t have an expiration date, as investors, we do get lulled into a false sense of security which can make sticking with the long-term investment plan more challenging when a downturn does come along. Reviewing the impact of past bear markets should make staying on course a bit easier.

Occasionally, clients and prospective clients will mention market timing and ask why we wouldn’t just get out of the market when “everybody knows” it is headed south. You may recognize this as a form of informal market timing we’ll refer to as the Just Get Me Out approach. There are more systematic approaches to market timing and I’ll cover those below. As for informal market timing, there are a couple of reasons that this can do real harm to a portfolio’s value over time and they are as follows:

- Ad hoc market timing usually involves selling when many others are selling (or the market would be declining) and prices are down. As for buying, it typically involves re-entering the market after others have piled back in and driven up the market price. Taken to extremes, this can become a buy-high sell-low approach that decimates portfolio value.

- The pattern of market returns, particularly early in bear market recoveries, is volatile, but up market days are typically sharply up. Investors who miss the returns on those days miss a sizable percentage of the overall market growth, thereby significantly lowering long term return.

- Entering and exiting the market both involve transaction fees and if taxable accounts are involved, taxable capital gains are generated as well.

There are, of course, more sophisticated and deliberate market timing systems. However, they have their own challenges and data shows that most systems aren’t successful. A few of the challenges with market timing are as follows:

- Timing systems provide signals regarding when to enter or when to exit the market, but a sizable percentage of those signals will be wrong. After a few false signals, it can be difficult for an investor to consistently stick with the system.

- Some of the signals may make no sense, particularly if the rules that govern the system are opaque. Given the first point above, if the system has already generated a few missteps, an investor might hesitate to sell in a rising market or buy in a falling market.

- Timing systems that work for a time can suddenly stop working as the example of the Value Line 4% shows in this article.

In spite of all the problems, market timing would be a worthwhile strategy if it outperformed a longer-term strategy, but the evidence shows this isn’t the case. Studies by Vanguard and others have analyzed the performance of both professional and individual investors who pursued market timing strategies and found that no group was able to outperform using market timing.

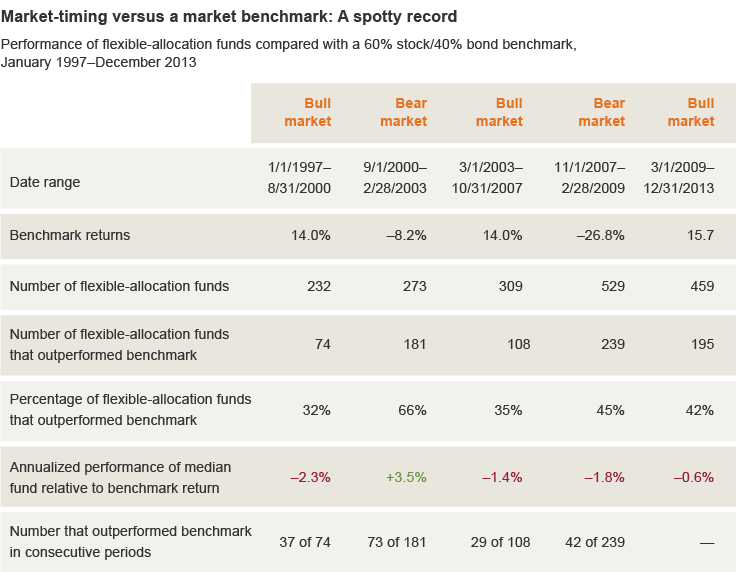

The case of flexible allocation funds was particularly interesting. Flexible allocation funds are funds that can move among a broad group of asset classes, and this mandate allows them to pursue a market timing approach. The chart below from Vanguard shows the performance of these funds versus a portfolio that consists of 60% stocks and 40% cash and fixed income.

The upshot of the above, per Vanguard is as follows: “ (1) in only one period did a majority of the flexible-allocation funds outperform the balanced benchmark; and (2) among those that did outperform in a particular period, less than half were able to carry that performance forward into the next period.”

For individual investors, this leads to a few issues. One is that if the majority of professionals with all of their resources and full-time focus aren’t able to beat the benchmark by market timing, is there a reason an individual investor is more likely to be successful? And if you are willing to hire a manager who practices market timing, you’ll want a system to identify a manager who is likely to succeed since the majority of managers do not. Past returns might be one metric you consider using, but if you do it is important that you find a way to distinguish skill in investing from simple luck.

From our perspective, market timing is more likely to lead to the failure of a financial plan than a longer-term approach that involves remaining invested through market ups and downs. We’ll talk a bit more about how we implement that approach and what historical results have been in future posts.

Micah Porter, CFA, CFP® is a financial planner in Atlanta (Decatur), Georgia.