It took my dad two tries to get through college. The second time he enrolled, I had just been born and my mom was the sole breadwinner with her job as a bank teller. We lived in public housing, and didn’t have money for much beyond the absolute necessities. There was zero chance that I would be spoiled by having too many things or fail to realize how hard people worked for what they had1.

Our daughter Ellie is growing up in a much different environment. We live in a well-to-do community and for the most part, parents can afford to give kids what they want. One of our concerns as parents is that our daughter might come to view all of this as the norm, not realizing that most people don’t live like this and money does not generally come easily.

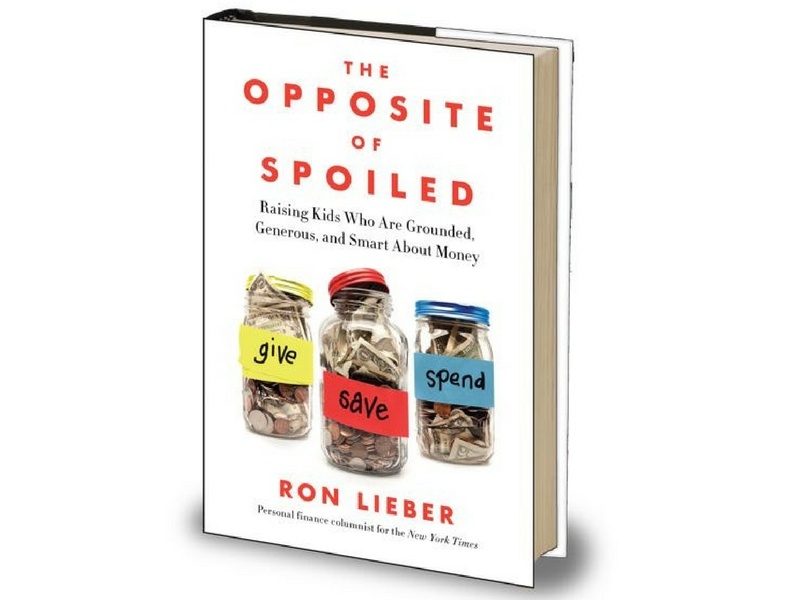

Given my concerns, I was excited to hear about Ron Lieber’s book “The Opposite of Spoiled” which is essentially a guide to teaching kids about money. Lieber is a long-time personal finance writer for the New York Times, and he wrote his book to help parents instill values to their children through how they dealt with money and financial issues. The biggest question I was hoping to answer was how to handle an allowance, but the book delivered much more than that.

Lieber covers a good deal of ground, but ultimately the book centers on issues at the intersection of money and moral values. Whether the question is around giving and charity, the importance of a work ethic or how to foster a sense of gratitude, the book offers a variety of suggestions about how money can be used to teach these things. The question to which I was seeking an answer – how to handle an allowance – is a good example.

One of the first questions I had about an allowance is whether to link it to things Ellie should be doing. Helping out around the house is something we all have to do, so why pay her for it? At the same time, I do think it is important for her to have the chance to earn and spend her own money. Lieber agrees with both points, and suggests that instead of tying chores to the allowance, other privileges can be withheld if chores aren’t done. If it is critical to a parent that an allowance be tied to work, one suggestion offered is to foster entrepreneurialism by having your child come up with ideas – beyond just the standard chores – for how they might help out around the house as well as a price for doing so.

The book goes on to provide a few examples of how to handle an allowance once it is earned. One suggestion is to divide the allowance up into three clear jars, labeled give, save and spend. The spend jar is essentially the child’s mad money that he or she can use to get inexpensive impulse items. The save jar is for larger items that require longer term savings, and Lieber suggests putting a picture of the item or items on the jar as extra motivation to save. The give jar is, obviously, for charity.

You and the child choose how to divide up the allowance — for every $5, you might put $1 in the spend jar and $2 in the save and give jars. To further drive home the importance of savings and charity, some parents pay interest or offer matching funds for money in the save and give jars. Hopefully, the lesson will stick and if the child gets a part-time or summer job – which the author recommends – the savings and charitable giving will continue.

The book covers a number of other issues, and if it is a common question parents have in teaching kids about money, it is likely covered in “The Opposite of Spoiled”. Reading it has made me better able to help Ellie develop good values through and around money, and it also helped me revisit and clarify my own financial beliefs and values.

- The second time in college was a charm. Dad not only more than doubled his original GPA, but he finished at the top of his class. ↩