Federal government pensions are really pretty complex because they’ve become progressively less rich.

The pensions for federal government employees that were employed before 1987, they had what was known as the CSRS or the Civil Service Retirement System pension. And after from 1987 onward, you had FERS or the Federal Employee Retirement System.

Federal employees that were employed before 1987 actually had a buyout option. They can elect to switch to FERS and get bought out of their CSRS pension.

The problem though is that CSRS was over time a lot richer than FERS. In private sector you’ll hear a pension referred to as a pension. Plain and simple.

However, FERS calls their retirement payout a FERS annuity. I don’t know why they do this because they offer the same sort of approach as a defined benefit pension. So in other words, the amount that you get paid is based on your highest salary three times the number years you worked times 1%.

They’re doing the same thing with all pensions, but for whatever reason they like to call it an annuity. Even after switching to FERS the government made FERS itself less rich as well. So, you may find employees with FERS, with old guarantees, and they’re a bit better off than employees who were more recently hired.

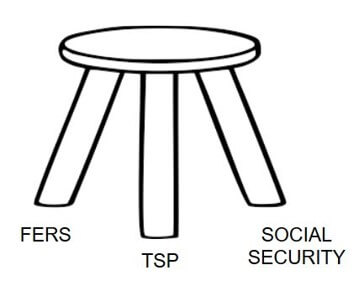

3 Primary Sources of Retirement Income

If you look at retirement as the old three-legged stool with the legs of the stool being your pension, the second leg being your savings, and the third leg being Social Security, FERS is the pension, TSP is your savings, and Social Security is Social Security.

If you look at retirement as the old three-legged stool with the legs of the stool being your pension, the second leg being your savings, and the third leg being Social Security, FERS is the pension, TSP is your savings, and Social Security is Social Security.

There’s something known as the ballpark estimator that as a government employee, you can use that will pull together all of your income sources and say, “Hey, based on what you’ve told us about your earnings, based on, you know, based on what you’ve put away in your TSP, here’s what you’re going to have. Here’s what you can expect in the way of income.” So, yes, they can go in and calculate that.

You can use the ballpark estimate here: https://www.opm.gov/retirement-services/calculators/federal-ball-park-estimator/

FERS withdrawals are taxed at the federal level, but luckily some states, like Georgia, exclude state income taxes on your FERS withdrawal.

Should you postpone FERS payout?

Let’s say you retire at age 63 and you don’t want to withdraw your money immediately because it may increase your tax rates. You can defer your withdrawals from FERS up until age 70, if you want.

However, usually what I find with most FERS annuities is that past a certain point, by delaying your FERS payments, you’re just treading water. What I mean by that is the total income that you get if you begin drawing at 65 versus 66 tends to remain the same.

I would definitely understand what the impact is on waiting on your FERS payments. Use the ballpark estimator and get your ballpark estimate at 62 and get the ballpark estimate at 65. Understand how much more you can get from FERS, if any, if you delay taking your withdrawals.

Use the FERS ballpark estimator here: https://www.opm.gov/retirement-services/calculators/federal-ball-park-estimator/

FERS and impact on Social Security

I don’t run across this very often, but I have seen pensions taken early pay out more. And then once the Social Security kicked in, the pension automatically reduces its payout. What the federal government is trying to do is ensure a certain level of income, regardless of where that income comes from.

It’s critical to understand the interplay of your FERS pension and social security particularly if you’re planning on retiring say before 62. As I mentioned before, the benefits get really complex particularly because the government changes them so often.

It’s really critical as you start looking at doing this that you find, you know, that you work with someone to really understand really understand how things impact you specifically. Because the way they impact you and the rules for you and your pension may be different than Bert down the hall who’s planning on retiring, too, but started earlier than you did, and therefore subject to a new set of rules.

The Ultimate Retirement Guide for Federal Employees

As a federal employee, your retirement benefits are complex. Download our FREE ebook to learn about the mistakes to avoid and the options that can make the most of your benefits.