If you study something intently enough, your views will evolve and investing is no exception. After college, I read a number of books on investing from authors like Peter Lynch, Joel Greenblatt and Burton Malkiel. All were useful, but the book that made the biggest impression on me was Securities Analysis by Benjamin Graham, followed closely by The Most Important Thing by Howard Marks.

Graham was Warren Buffett’s mentor, and Securities Analysis was essentially his instructional manual to value investing. At 700 pages, it takes commitment and it assumes the reader already has a decent knowledge of accounting and investing. When I read it at the time, I was enamored with the specificity as it outlined both the specifics of value investing and why it worked. The list of value investors who cite the book as a classic is long, and it is unquestionably useful for those who want to pursue value investing. The problem is that most of us aren’t solely value investors – we may build portfolios that tilt toward value investing, but we will also have exposure to a variety of bonds, equities that don’t fall squarely in the value category and potentially alternative investments as well. So is there a book of the caliber of Securities Analysis for the rest of us?

I think The Most Important Thing by Howard Marks comes close. Marks founded Oak Tree Capital, an investment firm that currently manages just over $100 billion. Oak Tree’s focus has long been distressed investing – buying equities and particularly debt of companies that were, at best, turnarounds. The book sprang from Chairman’s memos he began writing early in his tenure at Oak Tree. The story as he tells it is that in writing the memo to his investors, he often found himself outlining the most important thing, or issue, in the letter. What was most important changed from memo to memo, and the book is culled from those memos and in it, the reader will find twenty Most Important Things for an investor.

The book takes a much more philosophical approach than Securities Analysis and Marks describes it thusly:

The book is primarily about what I call “the human side of investing.” It does not offer much on financial analysis or investment theory – more how to think and how to deal with the psychological influences that interfere with investment thinking and a lot about the mistakes others make in their investing.

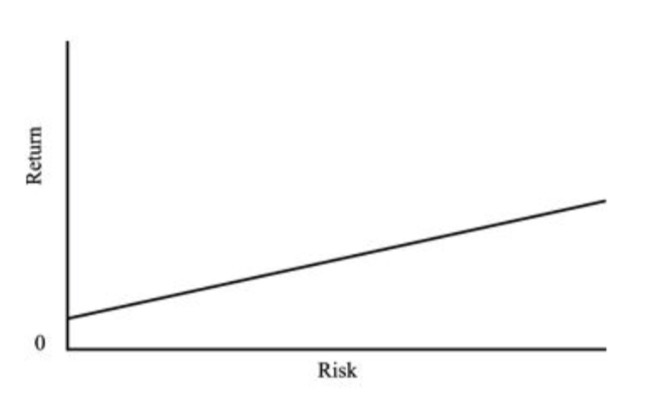

There are a number of quotes in the book investors would do well to remember (“Experience is what you got when you didn’t get what you wanted”; “Good times teach only bad lessons; that investing is easy…that you needn’t worry about risk”) and several chapters that are worth reading a few times. The chapter on risk, in particular, is invaluable for its unique take on what risk is and how investors should position portfolios to manage risks. Marks questions the conventional wisdom that higher risk leads to higher rewards. The graph showing the relationship is as follows:

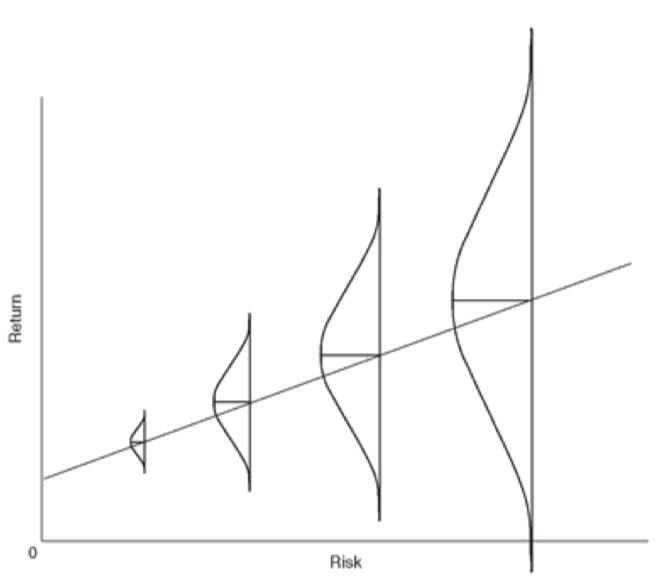

Marks argues that this is incorrect because it oversimplifies the relationship between risk and reward. Taking more risk, he believes, should offer the opportunity to achieve higher returns, but by definition, there is also greater risk of loss. The proper way to depict the relationship is below:

The former graph makes the relationship between risk and reward seem certain, while the latter makes clear that taking on more risk is not a panacea. On average, taking more risk can lead to higher returns, but the possible range of those returns is much higher. Simply piling on risk will not automatically lead to higher returns and it may well lead to losses.

He goes on to point out that risk can’t truly be measured until after the fact, and that

I think it’s fair to say that investment performance is what happens when a set of developments—geopolitical, macro-economic, company-level, technical and psychological – collide with an extant portfolio. Many futures are possible…but only one future occurs.”

There are a couple of key implications for investors if these two beliefs are correct, and they are:

- The fact that a risk wasn’t realized does not mean a portfolio was well positioned – an investor might just have gotten lucky.

- A portfolio should be positioned for a range of outcomes, although focus on a specific outcome can increase as probability of that outcome increases.

Beyond the three chapters on risk, Marks covers 17 other “most important things” for investors including second-level thinking, finding bargains and appreciating the role of luck. If you are looking for a book offering formulas and specifics on how and where to invest, this book isn’t for you. If, however, you’re interested in the distilled philosophy and beliefs of a top investor with nearly 50 years of experience, you should pick up The Most Important Thing.