Several weeks ago, I worked with a couple who wanted to retire early. At first glance, they seemed well situated to do so, as they had both worked as teachers for decades and they would thus both have a healthy pension. However, when I put together the plan, I found that early retirement was a good bit dicier financially than I had initially anticipated, and it took me a bit to identify the culprit to their financial health. It was inflation.

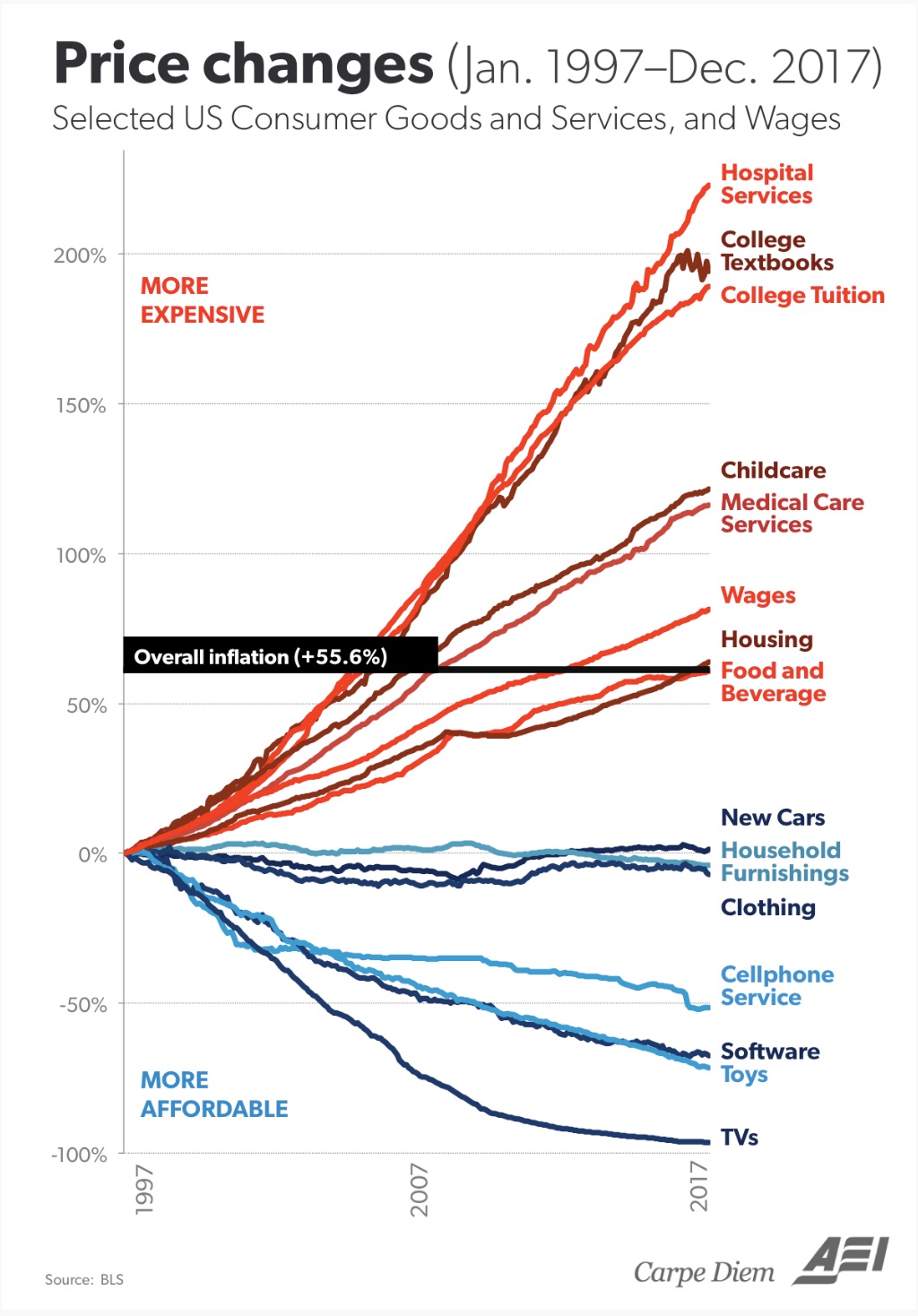

We don’t hear a great deal about inflation these days, because according to the most common measure the government uses, it has been at the low end of its historical range for years. Given the most recent reading of 1.8%, it will take prices nearly 42 years to double. In contrast, the average rate since 1970 is just over 4%, and at that rate, prices double in just under 19 years. However, in measuring inflation, the Bureau of Labor Statistics uses a hypothetical basket of goods and services and measures price changes over time for those goods and services. As you might expect – and as the chart below shows – different categories of goods and services have widely differing rates of inflation.

A few things stand out from the chart. First, wages haven’t risen much more than the rate of inflation, so it’s easy to understand why many Americans feel like their financial lot hasn’t improved much in recent years. Second, the extent to which healthcare and college costs have outpaced wage growth show why Americans are increasingly concerned about the affordability of both. Finally, it’s interesting to note that the goods and services whose prices have grown below the rate of inflation are mainly discretionary items while those above the line are mostly non-discretionary. The actual basket of goods and services you consume will differ from those the government uses to calculate CPI, so depending upon the composition of the basket, your personal inflation rate may be above or below the official rate.

So as an investor who is planning for long-term financial health, what do you do about inflation? First, you should plan for it. We build our financial plans using an inflation assumption of 4%, and we use rates higher than that for education and healthcare. There are good arguments for lower rates of inflation – particularly for education and healthcare – but we prefer to err on the side of cautioning use longer-term averages. Occasionally, a client will ask us to consider a scenario with lower inflation – and we will do that – but we’re mindful of the fact that there is next to nothing an investor can do to influence inflation.

It is also essential to understand what sort of inflation protection you have when it comes to retirement income and financial health. Social Security income is fully indexed for inflation, but most pensions are not. The clients I mentioned at the outset were recipients of Georgia’s Teacher’s Retirement System or TRS. The TRS pension is capped at 3%, so if the inflation rate does ultimately revert to its longer-term average of 4%, TRS recipients will have a bit less spending power every year, and over the long-term, the difference can be substantial. The Federal Employee Retirement System, or FERS, isn’t capped, but the cost of living adjustment begins to lag inflation once inflation exceeds 2%. FERS and TRS compare well to most private pensions though, as nearly all corporate pensions we’ve seen have no cost of living adjustment whatsoever – what the pension pays in year 1 of retirement is equal to what it will pay in year 30.

One last thing to consider when it comes to inflation is how the investments you choose are likely to be impacted. Existing bonds will probably drop in value if rates rise, but there are bonds whose interest rate increase as inflation increases. Stocks, too, typically lose some value over the short term as inflation reduces corporate profitability. However, over the long-term, newly issued bonds will offer higher rates to compensate for higher inflation and corporate profitability should rebound as companies pass inflation along to consumers. If you think inflation is likely to increase, you might consider buying shorter maturity bonds, so you have the opportunity to reinvest proceeds at higher rates sooner. As for stocks, it would be good to understand just how likely it is that any company you are considering will be able to raise prices on its customers to pass along inflation.

One last investment you might consider when it comes to inflation is real estate. Real estate – and particularly residential real estate – can offer a dual benefit to your financial health in an inflationary environment. First, you’ll very likely be able to raise rent over time to keep pace with inflation. Second, you generally have the option of taking out a mortgage in purchasing the property. If the mortgage is a fixed rate, your mortgage payments will remain fixed over the life of the loan even as the rent you earn from the rental property increases. Inflation isn’t the only consideration when it comes to investing in real estate though, and this post provides an overview of other issues to think through.

[…] has been pointed out countless times by various analysts (and confirmed by BLS data), there’s a significant variation in inflation […]