If you are planning to retire, budgeting for healthcare should be part of your plans. In fact, when we build plans, we have begun breaking out healthcare costs as a separate category. Doing so allows us to use the data we have on average healthcare spending in retirement and to inflate those expenses at a higher rate than general expenses. Nevertheless, your spending on healthcare will depend on your unique circumstances, and Vanguard recently published a white paper that provides a wealth of data that will be helpful for you as you plan for retirement.

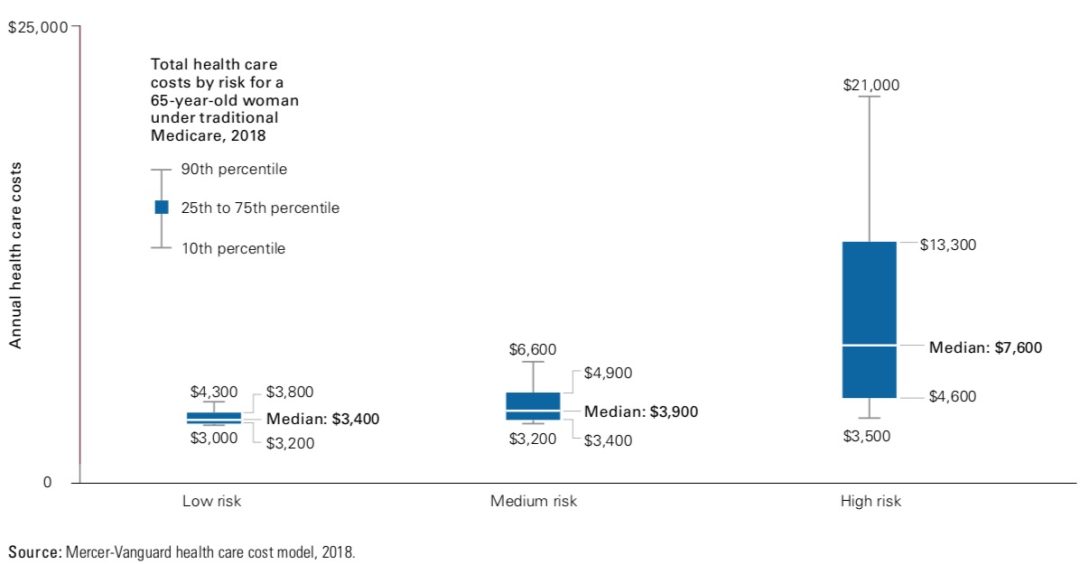

One of the first things that stood out in Vanguard’s study was the degree of variation in spending on healthcare. They focused on spending data for 65-year-old females – as expenses for women ran slightly ahead of costs for men – and they classified individuals as high risk, medium risk or low risk. High-risk individuals typically had 2 or more chronic conditions that necessitated frequent medical treatment, and they may also have been smokers. Low-risk individuals, on the other hand, had no chronic conditions and required little medical care. The chart below shows what each group spent on Medicare premiums as well as out of pocket medical, dental and vision costs. Note that these expenses assume no supplemental Medicare coverage.

The range of spending on healthcare obviously stands out, but the yearly expense is worth noting, too. Median spending for both the low and medium risk groups is somewhere around $300 a month, on par or less than the amount many retirees spend on groceries. Certainly, you should plan for this spending and recognize that it may vary a good deal. Still, we find looking at healthcare spending as an annual figure is more helpful and less alarming than headlines that blare about couples needing hundreds of thousands of dollars to cover health care in retirement.

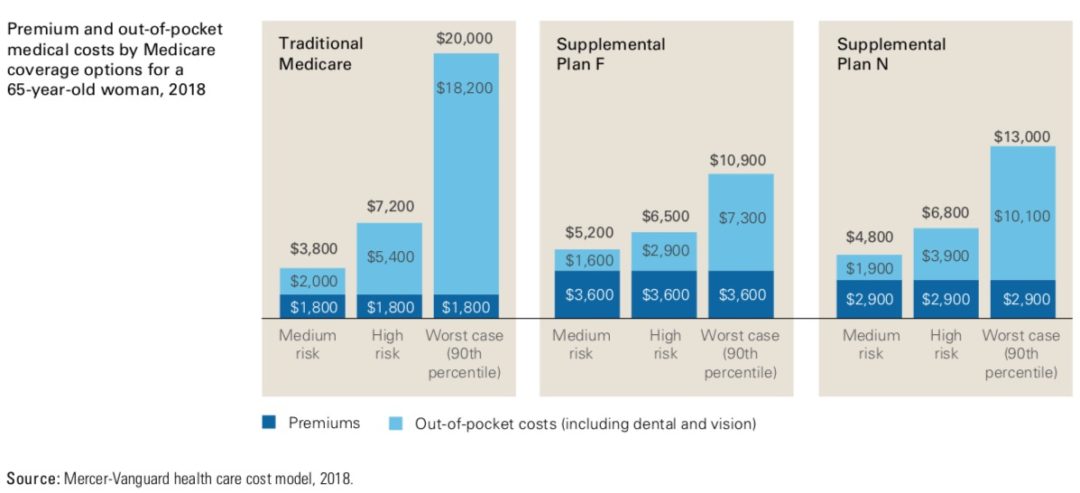

The initial cost data above assumes no supplemental Medicare coverage, but in our experience, nearly all traditional Medicare participants1 have supplemental coverage. Medicare supplement coverage pays some costs Medicare does not cover, and in some instances, the supplemental policy also covers services Medicare does not. From a financial perspective, a supplemental policy helps cap your total medical expense in retirement. If you don’t spend much on health care, you may find that purchasing supplemental coverage drives up your overall healthcare expenses. Still, we feel that it is a critical tool in reducing overall financial risk in retirement.

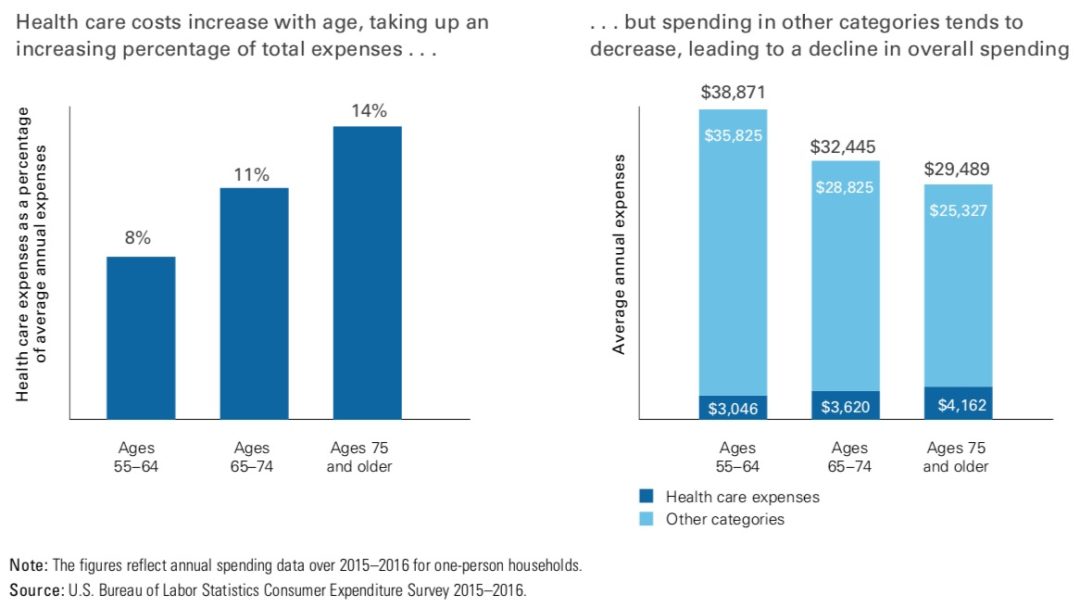

One last finding in the Vanguard report that dovetails with our experience with clients is that while spending on healthcare increases later in life, a decrease in other expenses more than offsets higher healthcare costs. While, as with healthcare costs overall, there is variation around this pattern, you can significantly decrease your risk by assessing initial health care costs accurately.

One last point to make is that healthcare costs do not include long-term care costs, and I’ll take a look at those in a future post.

- This is in contrast to retirees that are covered by a Medicare Advantage plan. Medicare Advantage plans are administered by private insurers, and typically there is one premium for a Medicare Advantage plan as opposed to a separate premium for medical, drug and supplemental coverage.