A client recently asked my thoughts on buying a house “in this market.” The market in question is Atlanta, and for most neighborhoods here, it’s a seller’s market. Prices have risen a good bit over the last several years, and well-priced houses in popular areas go quickly. The client wanted to buy, but the client’s spouse was concerned that prices had risen too far, and a recession was just around the corner.

If you’re purchasing a house, you might have similar concerns. After all, in most places, prices have risen a good bit over the last ten years, and there’s a decent likelihood of a recession in the next few years. So, should you buy now?

I’m going to assume you’ve already looked at the factors specific to you – what you can afford, how long you plan on living in the home, what your options are, and so on. What I’ll focus on here are the factors out of your control – interest rates and how prices tend to behave in recessions.

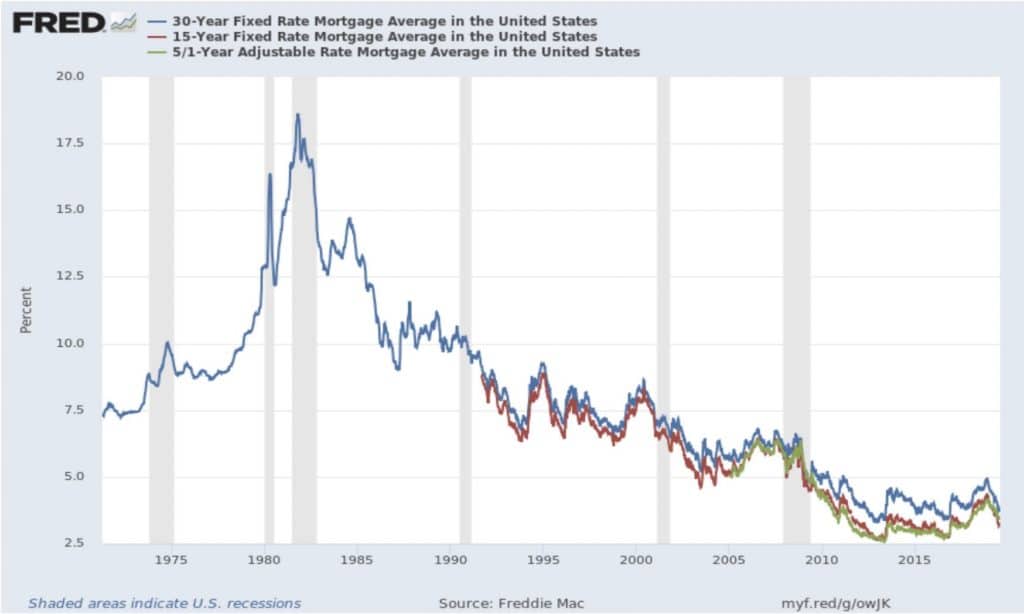

Interest is a significant portion of the cost of a home over the years, and the thing to realize about rates is that they are low. Really low. They haven’t quite touched the historic lows around 2013, but they’re not far off. They could go lower in a recession – as you’ll see in the chart below, they typically do drop a bit – but they won’t go much lower.

Right now, rates for a conforming 30-year mortgage with 20% down average 3.85%. If you purchased a $500,000 home and made a down payment of 20%, your mortgage payment would be $1875.23, and total interest over the life of the loan would be $275,0833.. The average rate for 30-year mortgages over the last 25 years has been 5.9%, and that equates to a monthly payment of $2372.55 and total interest of $454,116. So, while rates may go a bit lower in a recession, they are still historically attractive, and there is always the possibility they could reverse course and begin rising.

Things are a little trickier when it comes to home prices. They have risen a good deal since the Great Recession, but that doesn’t necessarily mean homes are overpriced. One of the best metrics to consider when looking at whether to buy a home is the price-to-rent ratio. To calculate price-to-rent, take the average home prices and divide it by the average annual rent. You can compare this number to the historical average to get some idea of where current prices stand relative to the norm. A related calculation if you’re looking at a specific home is to compare the total annual cost of the home – mortgage payments, taxes, maintenance and so on – to what it would cost to rent the home. If owning is more expensive than renting, renting might be the way to go, particularly if you don’t think you’ll live in the house for more than a few years.

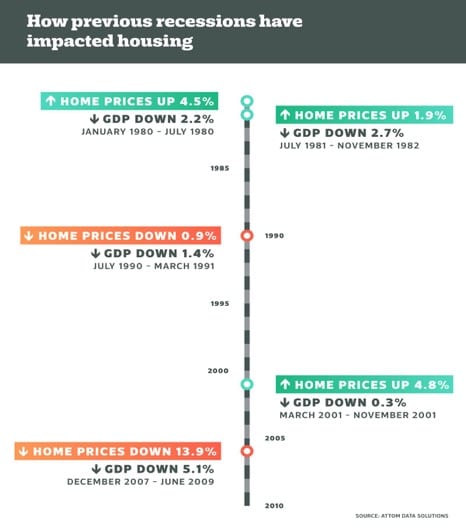

But what about home prices in a recession? Aren’t they likely to decrease? Home prices have dropped in previous recessions, but as the chart below shows, in the past 40 years, declines haven’t been common, and the decline in the Great Recession was by far the worst we have seen. Furthermore, over time, most homes will recover in value just as most stocks recover after a bear market – time erases losses.

The bottom line is that low interest rates make this a good time to buy, and a recession will likely have limited impact on home prices, although the effects will vary widely from market-to-market. Nevertheless, for most of us, fear of how a recession might impact the housing market should be the list of concerns when considering purchasing a home.