When it comes to investing, understanding an investor’s edge is key. The edge is what gives an investor a slight chance at beating the market. It could be something as complex as an algorithm that identifies small pricing anomalies or something as simple as having ready cash when no one else does. Edges are hard to find, making it hard to beat the market, but every now and then edges are fairly obvious — and that’s the case with interest rates now. Whether you’re focused on near-term retirement planning or a longer-term financial plan, understanding the implications of low interest rates and your financial plan can help you achieve your financial goals.

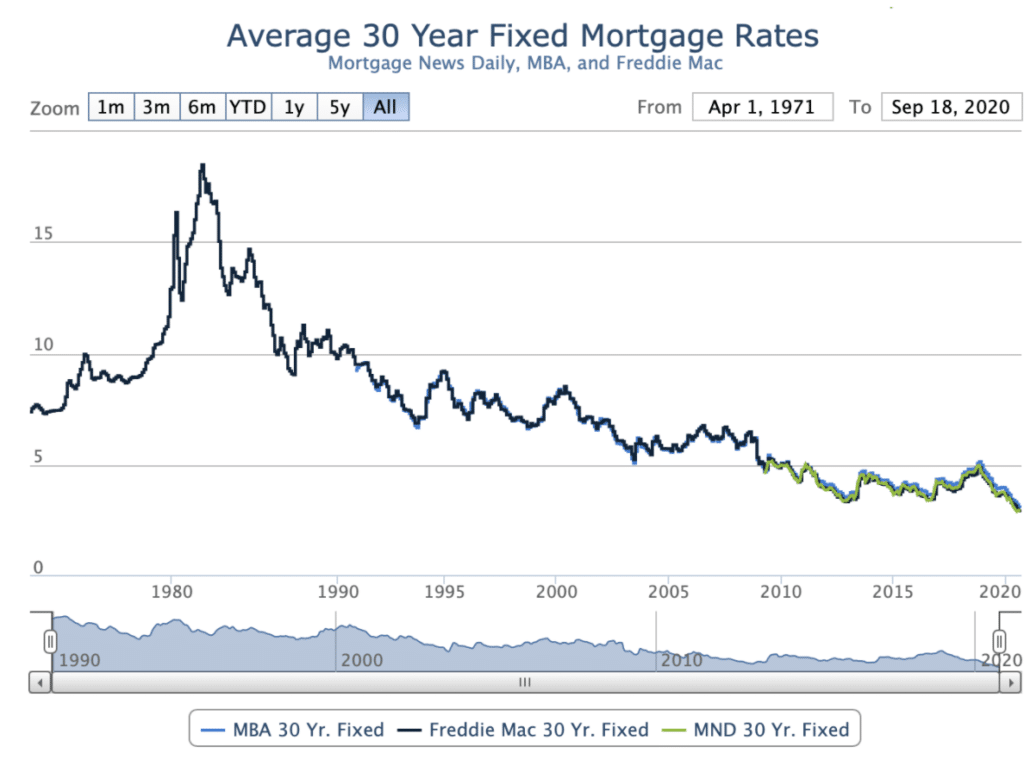

The chart below shows rates for the 30 year mortgage since 1971. Rates have been persistently low for the last decade, and in the last few months, they have hit all-time lows. If you’re a borrower, this is extremely helpful. In fact, if you haven’t re-financed in the last few years and do have a mortgage, it may make sense to re-finance (I’ve found Bankrate.com a good site to use to get a quick sense of where rates stand). We’re happy to take a look at any re-financing offers you might be considering, but here are a few high-level suggestions:

- When comparing loans, unless cash flow is a concern, don’t just compare estimated principal and interest payments on loans – compare the interest portion of each payment to understand how much the refinance will save.

- When comparing interest payments, compare both the monthly payment and the total interest. The reason to do this is because a lower interest rate might still result in greater total interest payments if the refinancing leads to adding a number of years to your loan term. For example, if you’re 12 years into a 30 year mortgage, the total remaining interest on that loan may well be less than a new 30 year mortgage – on which you’ll pay interest for 30 years – even if the new mortgage has a lower interest rate.

- Determine how long it takes for the re-financing to pay back by dividing closing costs by the monthly interest savings. So, for example, if closing costs are $3000 and you’re saving roughly $150 per month in interest, you’ll “pay back” these closing costs with interest savings in 20 months. Note that for closing costs, you just want to include costs incurred solely because of the refinancing, and not costs like accrued interest or escrowed amounts that you would have incurred anyway.

Many clients are in the fortunate position of not having any mortgage debt, but low interest rates can still have an impact in both positive and negative ways. We’ll start with the obvious negative – low interest rates will weigh down your overall investment return, and this is particularly the case with short term bonds, money market accounts and savings accounts. Fortunately for now, the low rates are occurring against the backdrop of very low inflation.

If the goal is to earn a higher return from fixed income, you’ll have to take some additional risk to earn that return at a time when the 30 year Treasury rate is just a shade above 1.4%. That risk may come in the form of lower-credit quality high yield debt, or you may choose to invest in longer-term bonds and accept the risk that interest rates rise. Before you do that though, bear in mind that a diversified portfolio includes both stocks and bonds and those different asset classes will likely play different roles. In our view, the primary goal of fixed income should be to preserve capital, and the amount of risk assumed on the bond side of portfolios should be fairly limited. We think this approach is particularly important when it comes to funds you may need in the near term, as we outline in this post.

On the plus side, even if you don’t have a mortgage, low rates can be potentially helpful in a few ways. First and foremost, if you want to sell your home, low rates have led to a booming seller’s market in many places. This is particularly the case for the higher end of the market here in Atlanta, where several clients have sold their homes in the last few months, often quickly with prices at or near their list price.

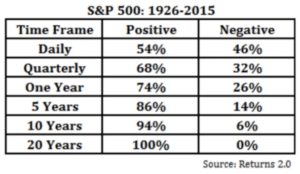

If you have plans to purchase a home and are planning to use cash, taking out a mortgage and investing some of the earmarked cash might well make sense. Market returns vary, but the longer the timeframe, the greater the likelihood stocks – and a diversified portfolio with a healthy weighting to stocks – will earn a positive return as the chart to the left from A Wealth of Common Sense shows.

Further, the lower the interest rate on your mortgage, the greater the likelihood your long-term portfolio return will exceed your mortgage interest rate. For example, if you earn 6% on a fairly conservative portfolio over the next 15 years while paying 2% on a 15 year mortgage, you’ve netted 4% on the difference between the two rates. There are some additional complexities to consider, like taxes and the possible need to withdraw

One last point to consider is that lower rates can make investing in real estate more profitable, assuming the real estate investment includes some leverage. This is particularly the case if you’re on the fence about selling a home or renting it. If you opt for the latter and can refinance at a lower rate, you can increase both your cash flow and return from the rental. All the standard caveats apply – consider carefully whether you want to be a landlord, vet each potential deal closely and so on – but historically low rates will likely be a boon to real estate investors in the coming decades.