In recent weeks, markets that were beginning to stabilize as the Omicron variant receded, are now being rattled by the attack on Ukraine. Sharp drops in the value of your portfolio – particularly after several years of growth – can feel unsettling. During these times, we find it can be helpful to consider what past market downturns have looked like and to understand how your financial plan is impacted by the current downturn.

What Causes Markets to Drop?

Markets don’t rise and fall arbitrarily, although sometimes it can feel that way. Ultimately, markets rise or fall on the ability of companies to generate profits and service debt. However, that ability is impacted by myriad factors and events including:

- War and other international or political conflicts

- Natural disasters

- Changes in fiscal or monetary policy

- Changes in the level of inflation

- A shift in consumer sentiment

Predicting any of the events above can be difficult, but even if a prediction bears out, it can still be difficult to forecast the economic and market impact. For example, the ‘08 housing market crash was predicted, but the extent of the bear market couldn’t truly be known until we were through it.

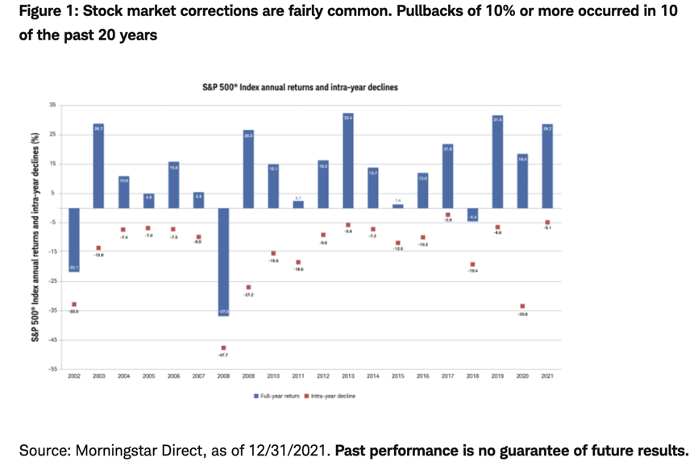

Are Market Fluctuations Common?

The truth is that market corrections (also called market downturns or market fluctuations) are incredibly common.

Graph source: https://intelligent.schwab.com/article/stock-market-corrections-not-uncommon

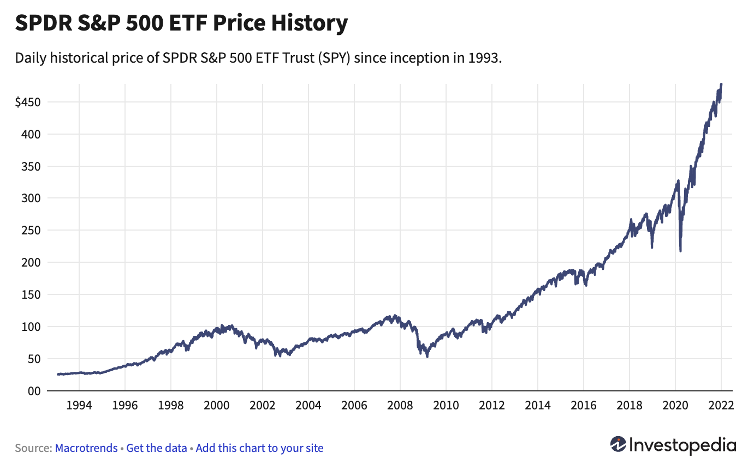

However, even though pullbacks happen often (according to the graph above, about one in every two years on average), the subsequent recovery leads to a market that rises over time. This is evident from the price history chart for the S&P 500 from 1993-2022:

Image source: https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp

During downturns, it’s helpful to assess your specific needs. You may be investing for a long-term goal and have no need of cash from your portfolio. If that’s the case, you’ll likely find that you’ll “make up” for any losses by staying in the market to realize future gains. If, on the other hand, you do need to draw from your portfolio, diversification can be particularly helpful in a downturn. Diversified portfolios contain investments in bonds as well as stocks, and more conservative bonds are relatively low-risk vehicles that are largely unaffected by market ups and downs. While they may not be earning a thrilling rate of return, they can provide stable income when you need it most.

Understanding Your Own Biases

Whenever a market fluctuates, it’s important to understand your own biases. Every investor is different and will have a different level of risk tolerance. However, no investor is immune to feeling stressed out or anxious about a significant market downturn, or a potential recession.

When the market corrects, emotions often take over. Every investor has his or her own risk tolerance, but few investors are immune to stress in a significant market downturn. Thus, we see sell-offs accelerate as stocks are liquidated and investors move to cash. Loss aversion is the idea that we feel losses more acutely than equivalent gains, and that may be one factor behind the idea that markets take the escalator on the way up, but opt for the elevator as they go down.

Investors also suffer from recency bias during market corrections. For example, if the market has been going down, or if it hasn’t been stable in recent months, you may assume that it will stay this way for an extended period of time. It can be hard to remember past “wins” when we’re faced with more immediate “losses.” Our brains highlight what’s happened most recently and project a possible future state based on that data.

Similarly, you may suffer from confirmation bias during a market correction. This builds on recency bias. As market drops continue, it becomes obvious that’s what will continue to happen (recency bias). To “confirm” you’re making a rational assessment about continued market drops, you look for data that supports your case.

This can create a destructive feedback loop, and it’s easy to see why. The more you worry about an impending market correction, or even a recession, the more likely you are to seek information that confirms your fears. As the market drop continues, you find more information to support the idea it will continue.

The good news is that you don’t have to get stuck in a destructive feedback loop. Just being aware of the biases you have can help you to notice them when your behavior shifts. Even if you end up falling into old habits or patterns, being cognizant of them, and understanding the “why” behind them can help you to stop yourself before making a decision that could negatively impact your long-term financial goals.

Remember: Your Financial Plan and Portfolio Is Built For This

Markets undergo periodic drops, and a good financial plan will reflect and plan for this. This plan, paired with a well-constructed, diversified portfolio that reflects your need are the best defense against market downturns. If you’re concerned about a market downturn, review your plan, understand how your portfolio has performed in previous downturns, and be aware of your cognitive biases.

Do you have questions about market fluctuations? We’re here to help. Reach out to us by clicking here. Together we can address any concerns you have about recent market turbulence, and create a long-term plan that’s rooted in your unique goals and values.