Many retirees face a mental roadblock when it comes to entering the “decumulation” phase of life. They’ve spent so many years building a comfortable nest egg, and the idea of saving is deeply ingrained in their financial values. When they do finally reach retirement, it can be uncomfortable and a bit confusing to take that nest egg and convert it into sustainable income for themselves and their spouse or partner. This is why tax-savvy retirement cash flow planning can help those who are newly retired or near retirement map out their income, and identify the best way to draw from their nest egg over time.

What Comprises Retirement Income?

In simple terms, your retirement income consists of:

- Withdrawals from your investments or savings.

- Social Security benefits.

- Pension benefits or other workplace retirement stipends.

- Additional income you may receive during retirement through a part-time job, consulting, rental income, etc.

- Insurance.

All of these different pieces complete your retirement cash flow puzzle. Let’s dig into what you can expect from each of them, and how they’re taxed.

Investment Accounts and Savings

This is one of the foundational elements of your retirement cash flow plan because you have the most control over it! You are in charge of what percentage of your pre-retirement income you save, and where you invest your money both. Where you invest your money includes decisions about asset allocation, investments used to implement that allocation, and where you locate your investments to achieve the greatest tax efficiency.

Accounts for Which Withdrawals are Taxed

For some accounts – like traditional IRAs – the amount you withdraw is taxed as income. You originally funded these accounts with pre-tax money – that is, the contributions you made while working were deducted from your income. Aside from traditional IRAs, there are a number of different types of accounts that accept pre-tax contributions, and a partial list includes 401ks, 403bs, SEPs and Simple IRAs. Because you didn’t pay taxes on your contributions, you’ll pay income taxes on your withdrawals in retirement.

Accounts on Which Withdrawals Aren’t Taxed

These types of accounts are funded by contributions on which you’ve already paid taxes. For example, a Roth IRA or brokerage account would fall into this category. These accounts are funded with money that’s already been taxed, so withdrawals aren’t taxed. However, even though neither Roths nor standard brokerage accounts are taxed upon withdrawal, Roths are even more tax-efficient as the growth of Roth accounts isn’t taxed either. Brokerage accounts, on the other hand, can generate taxes on capital gains and interest and dividend income in the account.

How Accounts Are Taxed: Simplified

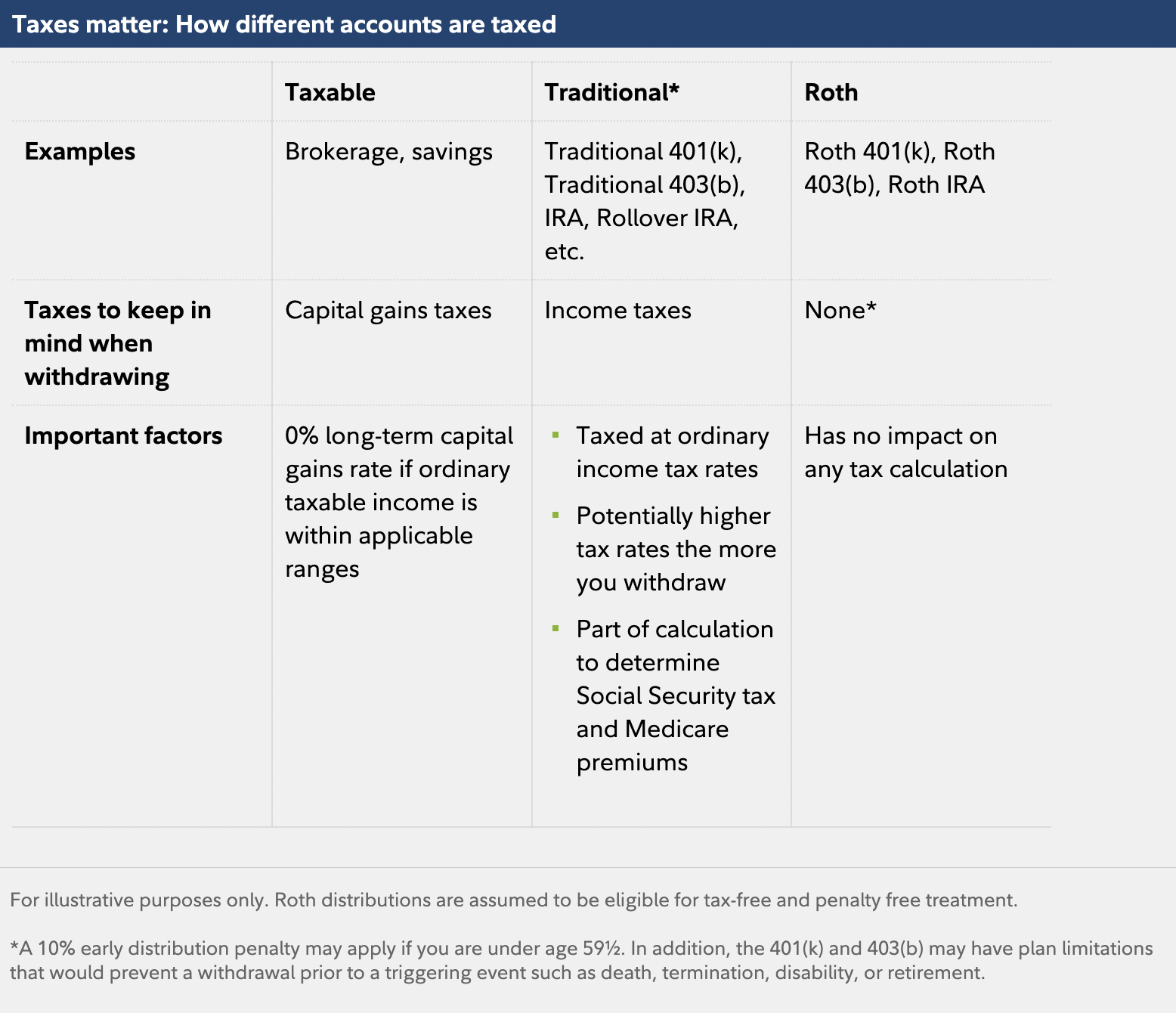

If you’re struggling to define which accounts you have and want to understand how account withdrawals might generate a tax liability, this table from Fidelity can help:

Source: https://www.fidelity.com/viewpoints/retirement/tax-savvy-withdrawals

Creating Tax Efficiency In Your Cash Flow Strategy

It’s critical to create tax efficiency in your cash flow strategy. The last thing you want is for your hard-earned savings to dwindle because of higher-than-necessary payments to the IRS. To create cash flow in retirement, you can choose the mix of accounts from which you withdraw to minimize your tax obligation. Typically, it’s recommended that you look to withdraw your funds in the following order:

- Non-qualified brokerage accounts. Any investment accounts you have that aren’t pre-tax or a Roth account will have a hefty tax obligation. Draw from these first.

- Pre-tax savings. Think: Your 401k or Traditional IRA.

- Roth accounts. The longer funds in your Roth accounts can earn interest tax-free, the more funds you’ll have to help you sail through retirement with ease.

Of course, this is only one example of a tax-efficient withdrawal strategy! There are many exceptions to this “rule”, and working with a financial advisor can help you to create a plan that’s unique to you.

Developing Savings “Buckets”

Having a tax-efficient strategy for your investments is critical, and having a well-rounded withdrawal plan for your investments can also have a positive impact on your cash flow in retirement. One way to do this is to organize your investments into “buckets” to draw from in order to get you to and through retirement. In your first bucket, you might have relatively conservative investments or cash to help fund your immediate needs in the first five years of retirement. You don’t want to take on too much risk with these investments, as the shorter the timeframe, the more unpredictable markets are and you don’t want to find yourself in the position of having to sell investments when they’re down in value. .

Your second bucket is intended for your mid-retirement years (often years 5-15). These investments entail a moderate amount of risk to grow your nest egg. You’ll also want to map out which accounts you’ll be using to fund your needs, and you may layer in additional strategies like Roth conversions and tax loss harvesting to minimize taxes.

Your third and final “bucket” is intended for late retirement and potentially leaving a legacy. Funds in these investment accounts may be growing tax-free – possibly in a Roth – and they can be invested in higher-risk funds given the longer timeframe. Creating buckets for your investments with tax efficiency in mind can help tide you through the inevitable market downturns while minimizing the total tax you’ll pay in retirement.

There is a good deal more to consider when designing your retirement income plan, so in Part Two of our series, we’ll cover a number of topics including decisions surrounding Social Security, pensions, and insurance.

Need Help?

If building out an investment strategy or cash flow plan as you approach retirement is a point of stress for you and your family, we’d love to help. Ready to learn more? Reach out to us today by clicking here. We look forward to hearing from you.