The primary goal of charitable giving is to support causes and organizations that are meaningful to you, but you shouldn’t overlook potential tax benefits. Understanding these benefits, and more specifically, the tax treatments of different types of donations, can create a win-win scenario for you and your favorite charities.

Key Takeaways

- Before you donate, ensure you select a qualified organization under tax law so you can take a deduction.

- There are different tax benefits for types of donations, like giving assets over cash, and the timing of donations, like bunching or donating annually.

- You can set up a charitable fund or account to reduce your tax liability.

The Basics: Deducting Charitable Contributions

For a charitable contribution to be deductible, the organization must be registered and qualified with the IRS. Eligible organizations operate exclusively for religious, scientific, educational, or literary purposes or to prevent the mistreatment of animals.

The IRS has a searchable list of charities to review before you donate.

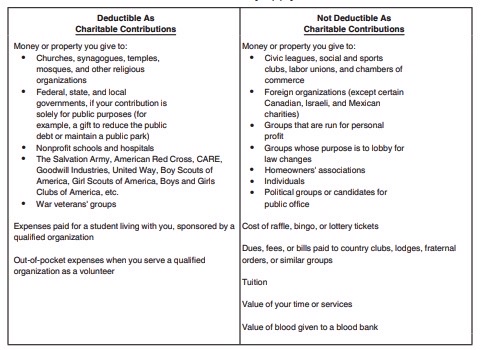

Examples of Charitable Contributions—A Quick Check

Deductible vs Non-Deducible Charitable Giving Contributions

Source: IRS Publication 526

Nonprofits must provide copies of their recent filings and tax-exemption application. You can request to see them before contributing. Many will even post the documentation through links on their website as part of their commitment to transparency.

There are tax deduction limits for gifts to public charities—note that this does not say that you are limited in how much you can give, just in how much you can itemize as a deduction. Annual non-cash contributions are limited to 30% of your adjusted gross income (AGI), and cash contributions are limited to 60% of AGI.

Remember, if you choose to itemize deductions, you’ll need to keep receipts, bank records, or emails detailing your gifts.

Donating Appreciated Assets

Instead of writing a check from an after-tax checking account, donating appreciated, non-cash assets is one of the most tax-smart strategies for maximizing your charitable activities.

By directly contributing the asset, you can generally eliminate other capital gains tax you’d have to pay if you sold the asset and then donated the cash.

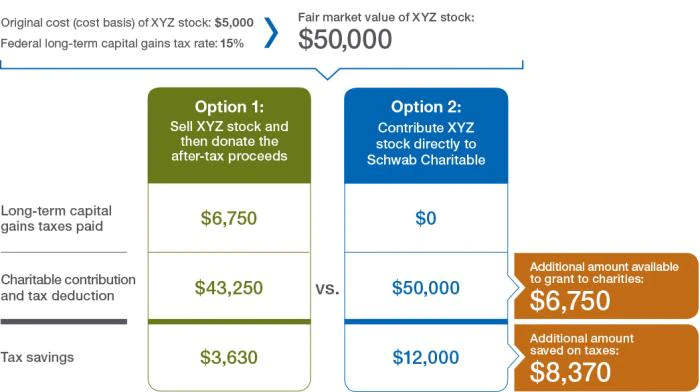

Take this simplified example of a stock valued at $50,000 at a 15% long-term capital gains tax rate, assuming you’ve held the asset for more than one year.

The tax benefits of donating appreciated assets to charity

Source: Schwab Charitable

The organization will need to sell your donation after the fact, but their tax-exempt status protects them from paying capital gains tax.

“Bunching” Gifts

For the 2022 tax year, the IRS raised the standard deduction to $12,950 for single filers and $25,900 for married couples. Charitably-minded taxpayers may find that even itemizing their contributions will not exceed the standard deduction limit.

In that case, you could “bunch” your 2022 and 2023 contributions into the 2022 tax year to allow itemized deductions to exceed the standard deduction amount – providing you a tax benefit from the donation.

You can combine bunching with the other tax strategies to boost the benefits from your charitable giving.

Donor-Advised Funds

A donor-advised fund is an account established to provide grants and other donations to a single or multiple charities. Donors contribute to the fund with cash, stocks, or real estate for an immediate tax deduction. The funds then grow tax-free and are distributed as grants over time.

You could donate appreciated assets and receive the same non-cash tax benefit mentioned above. The transfer acts as an in-kind transfer—the money never technically leaves the exchange—and avoids long-term capital gains tax while still being itemized as a charitable tax deduction.

DAFs also work well when combined with other strategies like bunching. For example, you could frontload the DAF with $30,000 you’ve received from vested equity or a highly-appreciated asset. You can itemize the deduction in year one and set up $10,000 grants for the following three years.

You could be the sole contributor or open the fund to other donors, like friends or family members. They can help you manage the fund or build a philanthropic strategy that continues for generations.

As an investment fund, albeit philanthropic, a DAF operates by a 501(c)(3) organization called a sponsoring organization. Many investment firms, like Fidelity or Schwab, offer DAF accounts. Keep in mind they may charge DAFs higher fees and require account minimums.

Using a firm or accredited sponsor ensures that your account is set up correctly. The IRS is aware of organizations that have used DAFs to generate questionable deductions and provide prohibited benefits to donors and their families. Familiarize yourself with the tax code to make sure yours operates per tax law.

Qualified Charitable Distributions

You make this type of donation directly from your IRA to a qualified charity. It isn’t included as taxable income like other IRA withdrawals, so you can use QCDs to reduce your Adjusted Gross Income, and by extension, your tax bill and possibly Medicare IRMAA premiums.

QCDs have a few limitations:

- You must be 70 ½ or older.

- The maximum annual distribution amount is $100,000 per person. If you file jointly, you and your spouse can each contribute $100,000.

- For a QCD to count towards the year’s required minimum distribution (RMD), the funds must be transferred from your IRA by December 31.

- QCD donations do not qualify for a deduction.

QCDs are a great way to fulfill your annual RMD and reduce taxable income. Although you can’t deduct the donation, you can still support the causes you care about while receiving a tax benefit.

Which Charitable Giving Strategy Is Right For You?

Deciding which charitable giving strategy works best for you depends on a few factors.

- What is your deduction strategy? Will you take the standard donation or itemize your deductions? If you choose to itemize, bunching may be a good option to exceed the standard deduction limit.

- Would selling assets create capital gains? Look at donor-advised funds or donating the asset responsible for capital gains.

- Are you worried about your Medicare premium or moving up a tax bracket? A QCD can be a simple way to reduce your taxable income.

- Do you want to set up a one-time donation or create a fund that lasts lifetimes? Donor-advised funds can keep a steady flow of funds to your charity of choice.

Your financial advisor and tax professional can help you navigate through the options. They’ll walk you through the current tax code and ensure that there aren’t any surprises during tax season.

Whatever your tax goals, Minerva Planning Group can help. Schedule a free consultation today to get your finances in order before the end of the year.