One of the many reasons to donate is supporting causes or organizations that are important to you. From homelessness to the arts to victimized animals, there’s almost certainly an organization doing good work.

But is the charity functioning as it should? There’s a way for you to find out with a little research and due diligence. Auditing charities ensures your money is doing the good you intended.

Key Takeaways

- Vet every organization before donating so your money is being used most effectively.

- A charity’s tax-exempt status requires its IRS application and finances are transparent and open for review.

- Search for the organization online, talk to other donors, or volunteer to see where and how the organization uses charitable donations.

Connecting Your Cause With A Charity

One difference between paying taxes and donating is genuinely caring about the cause you’re supporting. Make sure the organization you want to support cares about the same things you do.

1. Start with the organization’s mission statement.

Does it align with your values? Does it offer real solutions to the problems that most need solving?

You can find mission statements on websites, direct response mailers, postcards, or other marketing materials. If they aren’t clear with their purpose and it doesn’t connect with you, move on to the next charitable option.

2. Who is on their board of directors?

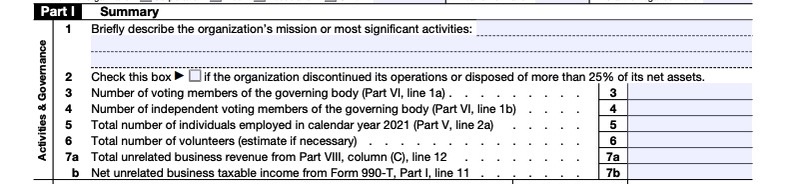

If they have a website, they will usually list the board there. If not, all nonprofits must file Form 990 annually with the IRS. You’ll find information about their mission, finances, and governance. Information about their board of directors is in the Summary section.

IRS Form 990 Summary Section

If board members aren’t voting independently (see line 4), it may be a red flag that they are operating under a different agenda than their mission statement.

Scroll down to the end to Schedule O, too. This section can provide additional information or explanation for the previous sections. It could give you an idea of how the organization operates.

3. How are they contacting you?

Emails and texts aren’t necessarily a sign of a scam, but their tone could be. Are they pushy? Do they ask for a wire transfer or request different payment methods every time? Most charities want you to feel good about your donation. They’ll provide you with a history of your donations and ask you to set up an account so you can stay in contact.

4. Do they have a history of scandal or other negative press?

A quick online search will show you if they’ve appeared in the press for all the wrong reasons. Try searching for the founder’s or chairman of the board’s name, too. They may be able to change the name of the charity, but their names will be harder to mask.

5. What progress have they made toward their goals?

Many organizations perform a self-audit and will report on their progress and achievements over the past year or years. Documented progress—or any documentation —is a good sign that the organization is reputable.

Check Their Legal Status

Every charity needs to apply to be tax-exempt and excused from paying taxes. That means they will be registered with the IRS and have a Form 99 to review. This proves they are qualified and that you can take a tax deduction for your gifts.

Some organizations will include their charity status on their website. Take the extra step and verify their application is also registered with the IRS.

Review Their Financials

Even if you’re not an accountant or financial professional, it can be helpful to review the financial records of your chosen charity. These records will show you exactly how they use the money.

You’ll be able to see how they compensate their CEO or board members. Some charitable organizations are complex, so they may need to pay their CEO and board competitive salaries to attract the right talent.

But, if it looks like most donations are support for compensation and administrative costs, you may want to research more before donating.

The good news is several businesses review financial records for you and provide a summary.

- Better Business Bureau (BBB) is a nonprofit organization dedicated to advancing marketplace trust by reviewing businesses’ financial health and reputation. They also review charities with grades from A+ to F based on 20 standards. If you see an NR next to your charity, that simply means they don’t have enough information to provide a complete evaluation.

- Find Best Charities To Donate is similar to BBB, but they focus specifically on charities. Their mission: “Helping donors give wisely.”

Understand How They Use Donations

Continuing your review of the financials will show you how the organization spends donations. Again, if this information isn’t available (either online or upon request), that could be problematic.

Ask if your donation will be used to purchase supplies to directly impact the people or animals you want to help. Does it look like they spend a lot of money on marketing or operating costs? If only a small percentage of your donation is going to direct aid, the charity may not be run efficiently. As a donor, you should be comfortable with how your donation will be spent or distributed.

Charity Navigator is another excellent tool to ensure charities are run efficiently, align with your values, and that a bulk of the donations go towards the stated cause.

Get Your Boots on the Ground

Reports are great, but your personal experience with the charity can give you a real-world perspective on how the charity is run and whether it’s making an impact.

The internet provides a wealth of information if you know where to outlook. Depending on the charity’s size, you’ll be able to find press about both the organization and its governing members. Don’t overlook social media either, as you could potentially find unfiltered reviews and opinions.

Consider volunteering at the shelter, food bank, or another facility where they operate. You’ll have the satisfaction of helping out, but volunteering also gives you a personal understanding of how the organzation operates.

Remember, after all the research, the only opinion that matters is your own. If you feel good about the charity and are confident they’ll use your donation responsibly, then send your contribution.

The benefits of donating to charities don’t end when you submit a payment. Donations have the double benefit of being tax efficient. Learn more about how to maximize your contributions.

We’re here to help you create a coordinated charitable giving strategy. Set up a time to discuss this with our team.