If you can’t escape Christmas music, cards are arriving daily and you’re near the end of your shopping list, it must be time for… year-end financial planning! If you’re preparing for retirement, reviewing your finances before December 31 can help you make strategic decisions and adjustments to maximize your money.

In this article,

- Get a snapshot of your finances by reviewing assets, debts, and retirement accounts.

- Make smart tax and investment adjustments to grow your retirement accounts and reduce your tax liability.

- Make changes to your healthcare coverage and prepare for future medical needs.

Step 1: Take Inventory of Your Finances

Before you retire, you’ll want to reduce the potential for financial stress when you transition to a fixed income. To prepare, put together a comprehensive look at your financial situation.

Assets

Review all your assets, including real estate, savings accounts, retirement accounts, emergency funds, etc.

- Are you hitting your savings and spending goals?

- Where does your retirement portfolio stand versus your expectations?

- Are your allocations still aligned with your risk tolerance, retirement timeline, and goals?

This initial review will help you identify what changes you need to make to your investments and how your cash flow stacks up versus your assumptions.

Debt

Next, look at your remaining debt, like a mortgage, car payment, credit card bills, medical bills, etc. If you have excess cash that you haven’t earmarked for savings, you can determine your most appropriate debt repayment strategy. Carrying debt into retirement isn’t detrimental as long as you have a plan (and funds) to cover it but be cautious about taking on additional debt before retirement.

Expenses

What other fixed expenses do you have? Think about:

- Known medical expenses

- Utility bills

- Insurance premiums

- Taxes (property, vehicle, income, etc.)

Consider making a list of set expenses you’ll carry into retirement to help determine how much you’ll need every month to cover the essentials. While there are general rules you can use to estimate retirement spending based on pre-retirement spending, nothing beats a line-item budget based on current expenses to which you can make changes based on changes you know will occur in retirement.

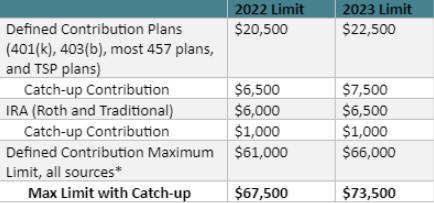

Step 2: Evaluate Your Retirement Savings

Now, take an analytical view of your retirement accounts. Are you hitting the milestones necessary to retire? If you’re falling short, now’s a good time to modify your contributions. You have until December 31 to hit the limits!

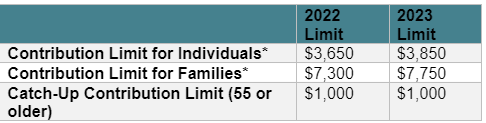

Remember, if you’re 50 or older, you’re allowed a catch-up amount in addition to the maximum contribution.

Source: IRS

Max Out Your HSA

Health Savings Accounts (HSAs) offer triple tax benefits—all contributions, gains, and distributions are tax-free if used for qualified expenses—and you can carry the balance over annually This is great news for pre-retirees, as HSAs let you save tax-free dollars and prepare for healthcare costs during retirement.

*Includes employee and employee contributions

Keep in mind that you can’t contribute to your HSA when you enroll in Medicare, so maxing out now could help you boost this fund for medical spending in retirement.

Use Expiring FSA Benefits

Flexible Spending Accounts (FSAs) are usually a use-it-or-lose-it health benefit. So, in most instances, you must spend the money in the account by the end of the plan year (typically December 31) or lose whatever is left.

You have a couple of options at this time of year.

- Use your benefits on permitted dental and medical expenses.

- Ask for a grace period or a small carryover amount. Some employers offer a 2.5-month grace period for unused funds, or you can carry over up to $500.

- Stop contributing money to your account if you cannot use or save what’s remaining.

Step 3: Make Smart Tax Calls

Leading up to retirement, you’ll want to examine all your accounts and make changes that will lower your tax bill and build up tax-free resources.

Roth Conversions

You fund Roth IRAs with after-tax dollars. You can contribute directly to a Roth IRA before retirement, but there are income limits that may reduce or prohibit your annual contributions.

To add to your tax-free retirement bucket, consider making a Roth IRA conversion.

This move allows you to convert pre-tax retirement funds from a 401(k), IRA, or similar account to a Roth. Converting your pre-tax retirement funds to a Roth IRA can be a smart financial move under the right conditions.

First, a couple of conversion rules:

- There’s no limit to how much you can convert, but you need to pay taxes on the total conversion. You can mitigate that tax bill by breaking up the desired conversion amount over a few years. Starting those conversions a few years before you retire can manage the taxes and build up tax-free retirement dollars.

- Converted funds need to follow the five-year rule, which means you must wait five years to withdraw any converted balances (including earnings) from your Roth account. If you withdraw before the five years are up, you’ll pay a tax penalty. The good news is the five-year timer starts the year you make the conversion, and you can withdraw funds on the first day of the fifth year. Any conversions made on December 31, 2022, can be withdrawn penalty-free on January 1, 2027.

A Roth conversion might make sense if you expect to be in a higher tax bracket when you retire, so you’ll pay taxes on the converted amount while in a lower tax bracket.

Tax Loss Harvesting

Tax loss harvesting is a strategic move to manage your capital gains liability by selling investments at a loss, purchasing a substitute for the security sold and then repurchasing the security after a set amount of time has passed. Tax loss harvesting is only applicable to taxable accounts, and not retirement accounts like IRAs, Roths or 401ks.

If you want to rebuy the stock in the future, follow the wash sale rule the IRS instituted to prevent tax avoidance by selling and buying stocks in a short period.

Step 5: Rebalance Your Portfolio

Markets move, and different segments of the market diverge from one another. This is important to you, because your portfolio should be invested based on a target allocation that reflects your specific return needs as well as your risk tolerance. You should check your portfolio on an annual basis to see if changes are needed to move you back to your target allocation. Market extremes, in particular, can offer a great opportunity to either raise cash (bull markets) or buy stocks (bear markets). Step 4: Conduct A Healthcare Check-Up

Year-end is also healthcare open enrollment season, so review your elections and start to make changes with retirement in mind. As detailed above, consider investing in an HSA. The individual owns HSAs, so your employer doesn’t need to offer one for you to contribute. But, you do need to be enrolled in a high deductible, high premium (HDHP) plan.

HSAs can also serve as a type of supplement to Medicare. If you’re nearing 65, use this time to review Medicare plans, premiums, and any medical needs that may not be covered. Knowing what you’ll need ahead of time can help you set and meet healthcare savings goals while you can still contribute.

Step 6: Looking Ahead!

Always keep an eye on the future. When planning for retirement, you’re planning for the rest of your life. Work with an advisor to set or adjust your short- and long-term retirement goals and determine what moves you can make this year that set you up to achieve those goals.

We’re here to help you map it out at Minerva Planning Group. Schedule a free consultation to ensure you’re on track to hitting your financial goals.