If you’re a federal employee and are planning on retiring soon, you need to understand when you can and when you should withdraw from your Thrift Savings Account (TSP).

In this article you’ll learn about the withdrawal requirements for your TSP as well as some of the pros and cons of withdrawing early versus leaving the money in your TSP.

Unfortunately, the TSP does not allow for more than one partial withdrawal from the TSP so it is a good deal less flexible in that regards than an IRA and other types of retirement accounts. Instead, when you retire, you have three options to withdraw money from your TSP:

- Take all of your money out (Lump Sum)

- Request monthly payments over a lifetime with the ability to change the amount of those payments

- Convert your TSP balance into an annuity and the amount you’ll receive is based on the annuitization option (link to first article) you choose.

Option 2 provides more flexibility than option 3, as once you make your choice of annuitization option, it can’t be changed. Under option 2, you can also continue to leave funds in the TSP invested in the options you choose, and over the long term, the return generated by these investments may well be greater than the interest paid by the annuity in option 3.

The advantages of choosing the annuity are that the annuity company will make guaranteed payments to you regardless of how the market performs or how long you (or your spouse, if he is a beneficiary) live.

Read this article to learn more about the specific withdrawal options for your TSP and how to choose the best one at retirement.

Delaying Withdrawals From Your TSP

If you leave the money in your TSP, you don’t need to start withdrawing until age 70½ even if you have already retired.

If you don’t need the funds from the TSP early in retirement, delaying drawing on the TSP can offer two advantages. First, those funds remain invested allowing their value to grow. Second, any withdrawals attributed to pre-tax contribution or growth are taxable as income so by delaying those withdrawals, you are delaying your tax liability. This tax advantage is even greater if your tax bracket when you ultimately do begin drawing from the TSP is lower than your tax bracket in early retirement.

Remember though, you are required to take money out of your TSP once you reach age 70½ and the amount you are required to withdraw (known as the Required Minimum Distribution or RMD) is based on both your age and the value of your TSP account.

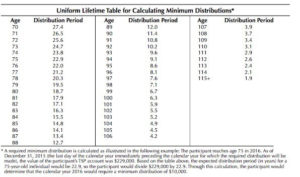

To calculate the amount you must take from your TSP account, most account holders will use the Uniform Lifetime Table, which is produced by the IRS. The table provides a distribution period that is based on the maximum age you reach in a given year, and you divide the balance of your TSP account as of 12/31 of the preceding year by the distribution period.

For example, let’s assume you turn 72 in 2018. To calculate the required minimum distribution for that year, you would divide the balance of the TSP account on 12/31/17 by 25.6, which is the distribution period associated with turning 72. So, for the year, you would need to take about 3.9% of the TSP accounts value and the RMD percentage climbs each year after that.

The reason the IRS requires you to take minimum distributions from the TSP is because any pre-tax contributions to the TSP has never been taxed.

Early Withdrawals and Loans Against Your TSP

Occasionally, clients need to take funds from their TSP account before they retire.

These types of withdrawals are known as in-service withdrawals and tax rules for these withdrawals are identical to the rules for an IRA. Anytime you withdraw from the TSP, the taxable portion is taxed as income and if you take money out of your TSP before you're 59 and a half and haven’t separated from service, there's an extra 10% penalty on top of that. Lastly, if you make a financial hardship in-service withdrawal, you can’t make a contribution for the following 6 months and any matching contribution will also cease.

What about borrowing money from your TSP?

You can borrow against the balance in your TSP using two types of loans. There’s a general purpose loan and a primary residence loan, and the former must be repaid within 5 years while the latter can have a term of up to 15 years. The rules on the total amount you can borrow are somewhat complex - and you can only borrow from your contributions plus what they earned - but in general, the maximum amount is limited to 50% of your vested account balance or $50,000, whichever is less.

So, if you have a $30,000 TSP balance, you can take out a loan of up to $15,000 max. If you have a $200,000, you can take out up to $50,000.

You must pay interest on any amount you borrow, and the loan is repaid by payroll deduction. The amount of the payment depends upon the term of the loan, and the term cannot exceed the timeframes mentioned above.

As an Atlanta based fee-only financial advisor, I can help you assess your TSP withdrawal strategies. Schedule a call with me anytime to review your best options.

The Ultimate Retirement Guide for Federal Employees

As a federal employee, your retirement benefits are complex. Download our FREE ebook to learn about the mistakes to avoid and the options that can make the most of your benefits.