The total cost of financial advice includes a number of items we’ve discussed in the last few posts. For clients who work with us those costs include:

- The hourly cost of the plan

- Cost for specific investment recommendations

- The ongoing costs of the investments

Not all financial advisors charge a separate fee for the plan AND for the investment recommendations. As I mentioned in a previous post, advisors who sell commissionable products may not charge a fee for either the plan or the investment recommendation.

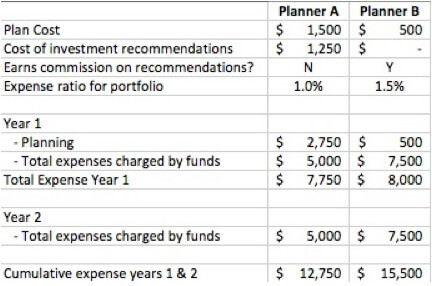

Getting a “free” plan and investment recommendations may not be a good deal, however, as the ongoing fees for the investments will, over time, very likely dwarf the upfront cost of a plan. As an example, let’s take a look at a hypothetical investor who has $500,000 to invest and has the opportunity to work with two planners as described below:

Planner A – works on a fee-only basis and charges for both the plan and specific investment recommendations. However, the funds recommended have a lower expense ratio as they do not have to recoup commission costs.

Planner B – charges a reduced fee for the plan and charges nothing for investment recommendations, but does receive a commission from the funds recommended. Thus, these funds have a higher ongoing expense ratio to recoup costs.

For our hypothetical client, here’s how the costs stack up:

The two lessons an investor can take from this are (a) the up front savings on a plan that’s subsidized by commissionable products can be very costly over the long-run, and (b) lower expense ratios are a key source of savings. So how do you find funds with lower expense ratios?

One of the easiest ways to find lower expense ratios is to look to index funds and passive ETFs. In fact, many industry insiders argue that the lower expense ratios associated with index funds, coupled with the difficulty of beating the market return over the long-term imply that investors should only purchase index funds. We don’t adhere to the idea of strict indexing, but it is clear that lower expense ratios are a key factor in long-term performance.

Even if you choose to use actively managed funds, you may still be able to reduce fund expenses by paying close attention to the share class. One mutual fund may be available in several different share classes, and each class is designed to be sold through a different channel. For example, one class might be available to retail investors through a commission based broker, while another might be sold directly to retail investors and have a lower ongoing expense ratio since no commission was paid for the sale.

As institutional investors we’re often able to purchase the institutional share class of a fund that typically has an expense ratio of 0.2% to 0.3% below that available to retail investors. This helps offset the fees we charge to our retainer clients and drives down the overall portfolio expense ratio.

One last thing investors can do to lower their overall planning expense is to take advantage of the tax deductions that are available. While mutual fund expense ratios aren’t deductible, the cost for planning and investment recommendations are, as are fees for those who work with their planner on an ongoing retainer relationship. Those fees are all deductible as a miscellaneous deduction subject to a 2% AGI limitation. So, for an investor who pays $5,000 in fees in a tax year with an AGI of $100,000 in a 25% tax bracket, the net tax savings would be $750, which equates to a 15% tax savings on planning fees.

Good financial planning advice will rarely, if ever, be free. However, if an investor focuses on minimizing the investment expenses and takes those deductions available, he or she can reduce the cost of that advice by a significant amount.