If you follow your investments closely in the Thrift Savings Plan, you’ve probably read about the controversy surrounding the TSP and China. One of the few issues with the TSP has been the lack of an investment option that includes emerging markets. Those are broadly – and loosely – defined as those markets that haven’t reached developed world status – among the long list of emerging markets is China.

The Federal Retirement Thrift Investment Board is the independent board that administers the TSP, and they have a fiduciary responsibility to act in the best interest of plan participants like some investment advisors have a fiduciary duty to their individual clients. The board decided a few years ago that TSP investment options should include emerging markets and they’ve been working to implement that change. However, as the relationship between the U.S. and China has deteriorated, that initiative has run into opposition within the Trump administration citing national security. Assuming the opposition is successful, how will that impact you and your investments in the Thrift Savings Plan?

As a financial advisor to Federal Government employees, my first concern is that politics and investing are rarely a good combination. In this particular case, on one side you’ve got the plan fiduciary whose primary responsibility is to plan participants, and on the other you have politicians, many of whom don’t really seem to have thought this issue through. If investing in Chinese companies via an index fund (more on that below) is a problem, should we be investing in companies that do business with or in China? What about other nations with whom we might have conflicts? Where will the line be drawn, and what will that do to investment options?

There are also slippery slope issues – if politicians exert undue influence or even take control of the functioning of the board, what else might they do to investment options or to the overall Thrift Savings Plan? As a rule, I get nervous when politicians become curious about large pools of investments others have saved. The board has done a good job building and maintaining a plan that has low costs and good, broad-based investment options. Allowing them to maintain their independence and fiduciary focus is in the best interests of plan participants.

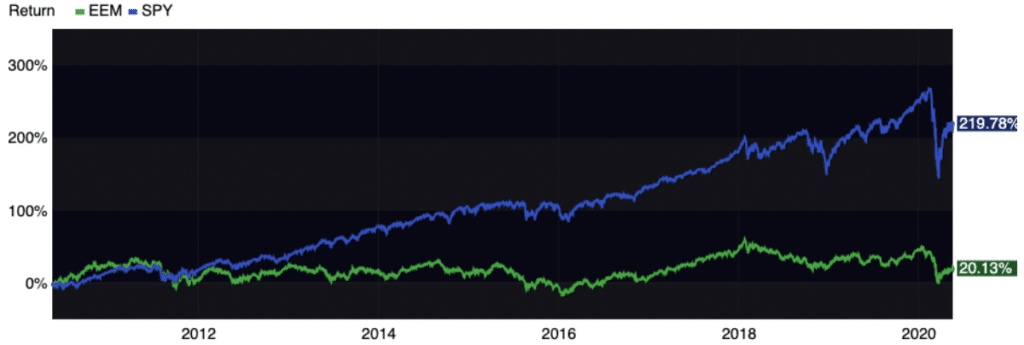

As to the proposed investment, it’s helpful to take a look at why one would want to invest in emerging markets and how it can impact your investment portfolio. If you looked at just the last 10 years and weren’t sold on the idea of diversification, you’d be hard pressed to come up with a reason to invest in emerging markets. As the chart below shows, U.S. markets (represented by SPY, an S&P 500 index fund shown in blue) have handily outperformed emerging markets (shown in green, represented by EEM), but that situation is unlikely to last.

There are two reason for that. First, U.S. stocks have gotten expensive compared to their international counterparts. By expensive, I mean that stock valuations – most commonly thought of as the price of a share of stock compared to the dividend paid by that share – have gotten quite high compared to their historical averages. An investor might argue that’s because U.S. stocks will grow more quickly than stocks elsewhere, but the problem with that argument is that corporate profits were, until recently at record highs. Further, most forecasters anticipate that the U.S. economy — and most developed economies – will grow at a slower rate than emerging markets. So, it’s tough to see how U.S. markets would continue to outpace emerging markets over the medium term. If this proves to be the case, Thrift Savings Plan investment options that don’t include emerging markets mean you’ll be missing a likely source of meaningful growth over the coming five to ten years.

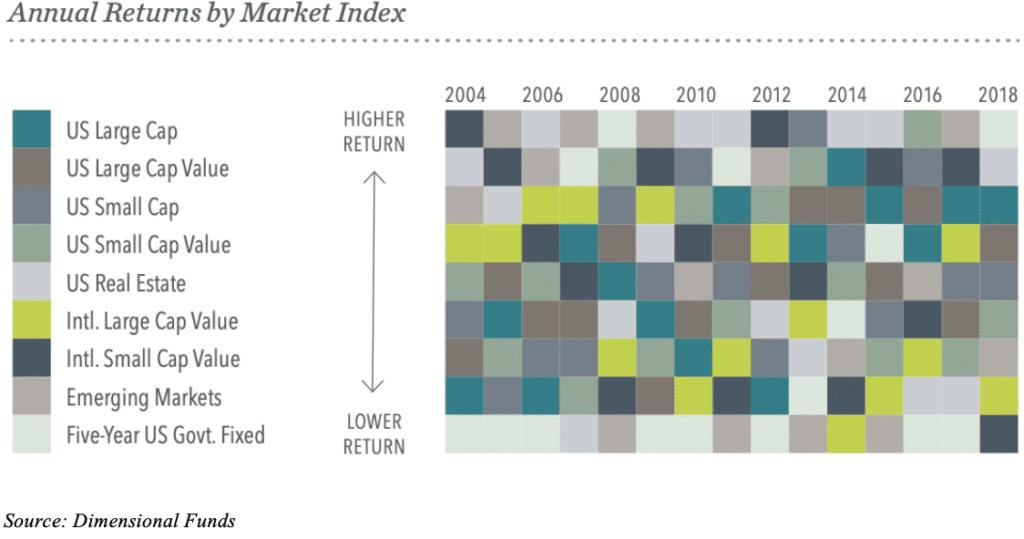

We have seen this situation before. The chart below shows the returns of different asset classes (and that’s what most of the funds in the TSP represent) historically. Each specific color represents a specific asset class, and each column represents a year. What the chart shows is that no asset class consistently dominates or lags peers over long periods. Instead, asset classes mean revert – those that outperform for long periods then underperform, and vice versa.

Trying to time the outperformance or underperformance is difficult to put it mildly, and that’s where an investment strategy that includes diversification comes in. Building a portfolio that includes all asset classes should provide a steadier return over the long-term.

As financial advisors to Federal Government employees, our hope is there will soon be an investing option that provides the TSP emerging markets exposure, particularly because it’s one of the few holes we seen in the TSP versus 401k plans. More generally, the less politicians interfere with decisions by those hired to represent the interests of plan participants, the stronger the TSP will be.