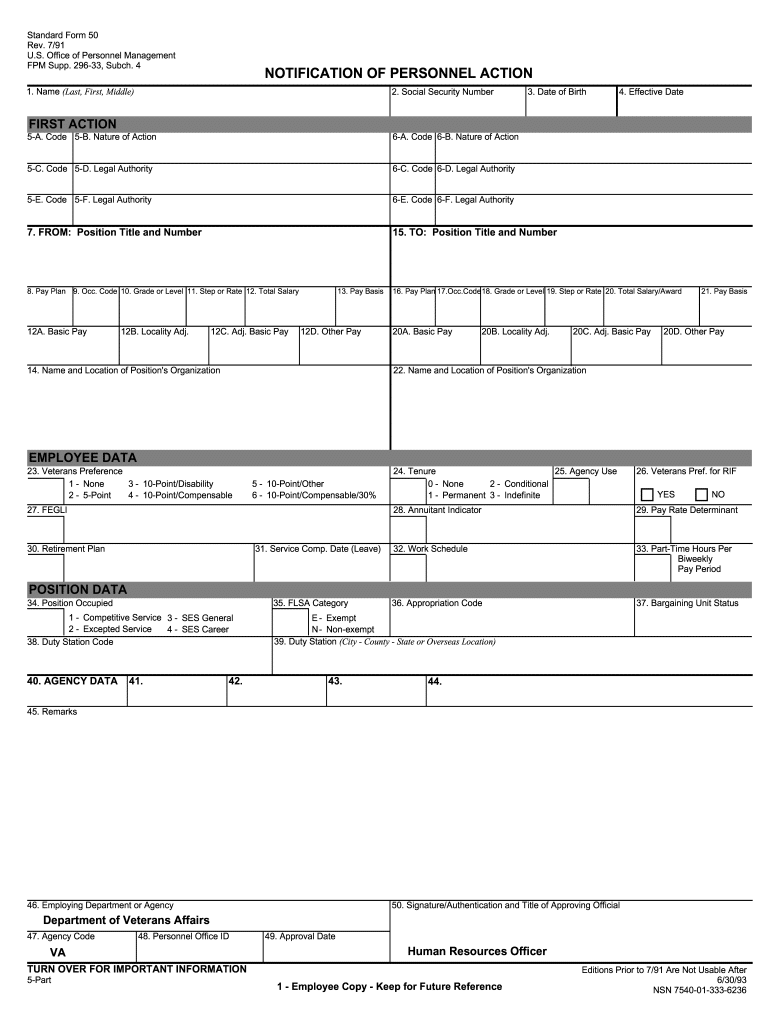

When it comes to retiring as a federal government employee, there’s one form that’s absolutely indispensable. Known as Standard Form 50, or SF-50 for short, this is the official form used by the government to determine your retirement eligibility and calculate your pension.

The SF-50 is a legal government document and the only official proof that you worked for the government during certain time periods. You should receive a new SF-50 each time you change federal government jobs or have an increase in step, grade or pay.

What’s on Your SF-50?

Your SF-50 will include your service computation date, federal retirement system and the amounts that will be used to calculate your high-3 salary. (Read more about the high-3 salary calculation here.) All of your SF-50 forms should be kept in an official personnel folder (or OPF).

In addition to pay and position changes, the SF-50 includes information about your federal government retirement plan and life insurance coverage, as well as a number of different personnel actions such as:

- Appointments

- Separations

- Placement and return to duty from non-pay status

- Conversions to permanent appointment from temporary appointments

You’ll want to look especially closely at the following sections of your SF-50:

Blocks 9 and 17 — These are Special Provision codes where accuracy is paramount. Mistakes here can end up delaying retirement.

Blocks 12c and 20c — These include the numbers that will be used by OPM to calculate your high-3 salary.

Block 30 — This specifies which federal government retirement system you’re participating in.

Block 31 — This indicates your SCD. Note, however, that this is not the date used for your pension calculation — your RSCD is used for this, and it doesn’t appear on your SF-50.

Gather All of Your SF-50s

It’s important to keep all of the SF-50s that you receive throughout your federal government career. Before you file your retirement paperwork, you should make sure you have a copy of each one of them and then review them carefully for possible errors.

If you’re missing any SF-50s, request a copy of your OPF from your agency’s human resources department — this should include all or most of your SF-50s. If any are missing, you may need to contact the National Archives and Records to obtain them (click here for more details). Once you have all of your SF-50s, arrange them in chronological order by their effective date with the earliest on top and review them for accuracy, focusing mainly the “three Cs”:

Correct — Is all the information accurate and complete? Look especially closely for typos since simple mistakes like this have been known to derail carefully laid retirement plans.

Creditable — Does the employment described actually count toward your retirement?

Continuous — Are there any breaks in service, gaps in your SF-50s or missing dates between period of employment?

Ideally, you should review your SF-50s as soon as you receive them. But if you haven’t done this throughout your career, it’s critical that you do so as you approach your retirement date. It’s not unusual for mistakes on SF-50s to result in retirement delays.

For example, one federal government employee was told one month before his planned retirement date that he wasn’t eligible to retire because six months of his employment was cited as not creditable on one of his SF-50s. It turned out that the problem was a simple typo on his SF-50. The employee ended up having to work an extra month while the issue was resolved.

An Essential Part of Retirement

Standard Form 50 is an essential part of retirement planning for federal government employees. Therefore, make sure you understand what’s on your SF-50s and how to review them for accuracy before your planned retirement date.

The Ultimate Retirement Guide for Federal Employees

As a federal employee, your retirement benefits are complex. Download our FREE ebook to learn about the mistakes to avoid and the options that can make the most of your benefits.