The weather has turned pleasant here in Atlanta in the last week or so, and that has coincided with the beginning of what may be a systematic approach to European debt problems. Still, as with most political issues, the ultimate outcome is uncertain. While that uncertainty continues to exist, expect to see further market volatility.

With that as preamble, I thought it would be useful to revisit the question in the first article below of what would trigger the unwinding of defensive positions in portfolios. One key to understanding our thought process is that we try to quantify likely market returns as opposed to relying on vague ideas of what the market might do.

In the financial planning tip of the month, we delve into two pending legislative issues that will likely impact most investors. For both issues, industry associations we believe represent consumers well are on one side of the issue, while deep pocketed institutional interests are on the other. Finally, in the question of the month we cover market futures, and how they are used to predict where the markets might open on a day-to-day basis.

As always, please feel free to send any thoughts or questions our way.

Best regards,

Micah Porter, CFA, CFP®

One of the key points I’ve reiterated over the last several investment commentaries is that we remain defensively positioned due to the ongoing risks in the market and the broader economy. Given that one of these risks – the European debt crisis – has recently flared again, I think it’s worthwhile to revisit how risk and defensive positioning are related.

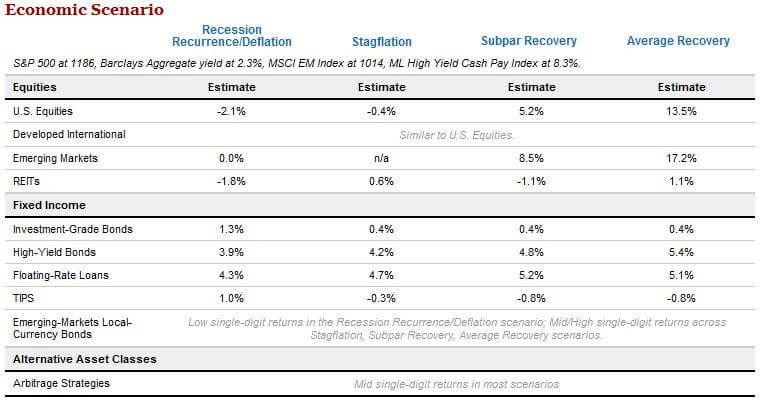

Typically, the reason investors take on more risk is the expectation of greater return. Thus, another way of stating the idea in the paragraph above is that the additional return we expect to receive in the near term isn’t great enough to entice us to take on more risk. While this might sound like a subjective judgement, we try to make it less so through relying on an objective, repeatable process. More specifically, we use research that involves scenario analysis to estimate returns on various asset classes. The most recent scenario analysis produced by Advisor Intelligence, one of our research sources generated the following:

As you can see (click image to enlarge), the estimated returns under most scenarios for equities over the next 5 years are fairly lackluster. Absent a sharp market drop or economic data that indicate a shift towards the most favorable scenario, there’s not a good incentive to move from the underweighting we currently have in equities. To put it another way, were investor unease to lead to a market drop of 20% or so in the U.S., we would expect the market to return an additional 4% per year over the next 5 years assuming the economic fundamentals hadn’t changed. Thus, even in a subpar recovery, we would expect returns of over 9%, which would provide us sufficient incentive to take on a bit more risk.

While the returns estimated above aren’t great, they are in line with what we’d expect given a halting recovery. As we’ve maintained for some time, given that this is a debt-driven downturn, recovery simply takes longer. On the bright side, though, there is some evidence that market valuations are now fairly reasonable (see articles here, and here). If that proves to be the case, over the longer term, we should expect healthy returns as we work through ongoing economic issues and enter into a growth phase again.

Financial Planning Tip – Legislation that Impacts Investors

Micah Porter, CFA, CFP®

I don’t often discuss political topics when it comes to financial planning tips, but in rare instances, Congress considers legislation that can have a direct impact on your long-term financial health. In this particular case, there are two issues before Congress that fall into this category.

The first regards whether or not all who offer investment advice should be held to the same legal standard. Currently, registered investment advisors (RIAs) like Minerva are regulated by the SEC or the states and held to a fiduciary standard. This is a strict standard, and requires that we act in our clients’ best interests at all times. The other, more common standard within the planning industry is the suitability standard, and most brokers and non-RIAs adhere to this standard.

To understand the difference in the two standards, consider a hypothetical investment recommendation. The RIA, subject to a fiduciary standard, would have to recommend what he or she felt was the best investment for the client, while the broker would simply be required to recommend a suitable investment. In the latter instance, a bond fund paying a high commission but having a poor performance might well be suitable, but it clearly would not be the best recommendation. If, on the other hand, the RIA subject to the fiduciary standard made such a recommendation, he or she could be found liable for violating that standard.

As part of the Financial Reform bill, there was consideration as to whether a fiduciary standard should be extended to all advisors. The jury is still out on whether that will happen, but there is strong conservative opposition to a uniform fiduciary standard. Further, the second issue is that FINRA, which currently oversees brokers subject to the suitability standard, is making a strong push to regulate RIAs as well. A number of industry associations, including NAPFA, the Financial Planning Association and the Certified Financial Planning Board of Standards are against this move. Given that FINRA is funded by the brokerage industry and has no history of regulating based on a clear standard – and instead regulated via very specific, costly and cumbersome rules – it’s easy to understand why FINRA would not be the optimal choice.

The bottom line is that we feel it is clearly in the best interest of investors to implement a uniform fiduciary standard across the industry. Further, we feel that the states and the SEC are the appropriate, neutral regulators of registered investment advisors. While there are deep-pocketed interests who have the ears of many in Congress, constituent feedback can help shape the ultimate decisions that are made, so feel free to let your Congressman know how you feel.

More in-depth information on both of these topics is available at the Certified Financial Planner Board of Standards website here.

Question of the Month – Why Don’t More Advisors Recommend Gold?

Micah Porter, CFA, CFP®

One of the daily rituals in the financial press is to look to the futures market in the early hours before the stock market opens. The reason they do this is that futures offer a good indication of how the market will likely perform once it opens. But what are futures, and how accurate are they?

A future is an agreement to trade a specified amount of an asset at a specific future time and date. In this particular instance, the asset being traded is the index itself. These trades take place throughout the night and into the early morning, and the movement of the futures price during these hours is considered indicative of the likely movement of the market when it opens. Thus, if futures prices move upward, the market is expected to move upward when it opens and vice versa.

The predictive accuracy of futures often only extends to the first few minutes after the market opens, but even so, for traders who watch the market on a minute-to-minute basis, the information is still useful.

As an example, the chart below on the left hand side depicts the S&P 500 on September 6th and 7th. You’ll note that the market “gapped up” from the 6th to the 7th, and if you had been following the futures chart on the right, you would have anticipated this movement. Futures trended up throughout the period from the close of the market on the 6th to the opening on the 7th, and the market opened up as anticipated.