When President Trump announced several weeks ago that he was freezing pay for Federal employees, it had to feel like Groundhog Day. The top pay increase in the last 7 years came in 2010, and… Read More

When President Trump announced several weeks ago that he was freezing pay for Federal employees, it had to feel like Groundhog Day. The top pay increase in the last 7 years came in 2010, and… Read More

The Thrift Savings Plan, or TSP, is the Federal government’s version of a 401(k) plan and if your goal is better understanding the TSP, we have written an overview of the plan . Is the TSP a 401k?… Read More

Several weeks ago, I worked with a couple who wanted to retire early. At first glance, they seemed well situated to do so, as they had both worked as teachers for decades and they would… Read More

I recently completed work with a client who was considering switching jobs. It was an interesting case, as the switch involved moving from a job with a pension plus a 401k-like retirement plan to a… Read More

If you are a federal employee and are considering early retirement, this article will help you understand your options and how to determine if early retirement is feasible. We’ll examine how your FERS annuity and… Read More

Federal government pensions are really pretty complex because they’ve become progressively less rich. The pensions for federal government employees that were employed before 1987, they had what was known as the CSRS or the Civil… Read More

If you’re a federal employee and are planning on retiring soon, you need to understand when you can and when you should withdraw from your Thrift Savings Account (TSP). In this article you’ll learn about… Read More

Two big risks in retirement are inflation and poor market returns, and in this article I’ll discuss how income layering can help cover those risks Inflation is an often overlooked risk to a successful retirement,… Read More

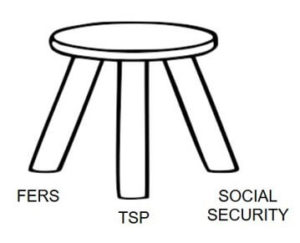

Not so many years ago, financial advisors viewed retirement planning as a 3-legged stool. The first leg was a pension, the second social security and the third being the retiree-to-be’s savings. In the intervening years,… Read More

One of the most rewarding aspects of being a financial advisor is working with clients when they realize a financial plan isn’t really about finances, per se, but rather what they want to accomplish with… Read More