In last week’s post, I covered a few things you should consider in setting up withdrawals from your portfolio in retirement. One of the considerations was planning for taxes, and more specifically, how you can… Read More

In last week’s post, I covered a few things you should consider in setting up withdrawals from your portfolio in retirement. One of the considerations was planning for taxes, and more specifically, how you can… Read More

An aged man is but a paltry thing, A tattered coat upon a stick, unless Soul clap its hands and sing, and louder sing For every tatter in its mortal dress – WB Yeats, Sailing… Read More

Stepping in and helping parents with finances can be a challenge. In some instances, the parent needing the help may have managed finances for decades and be reluctant to accept help. At the opposite end… Read More

I was listening to a podcast recently featuring Meir Statman, an academic who has long focused on the field of behavioral finance. While the topic itself was interesting, one thing Statman said that stood out… Read More

Federal government pensions are really pretty complex because they’ve become progressively less rich. The pensions for federal government employees that were employed before 1987, they had what was known as the CSRS or the Civil… Read More

In last week’s post, I walked through the challenges of market timing strategies in investing. The buying low and selling high that characterizes an ad-hoc approach doesn’t work, and it can be tough to stick… Read More

I’ve begun reviewing what happens in market downturns in client meetings. It isn’t because I believe a bear market is just around the corner, but rather because it has been nearly 10 years since the… Read More

In last week’s post, I walked through a series of questions you should consider when it comes to a new car purchase. If you’re like me, it’s tough to resist the combination of new car… Read More

The phrases “car guy” and “financial advisor” don’t normally go together. The average American owns 13 cars in his or her lifetime at a current average cost of $30,000 per car. If your goal is… Read More

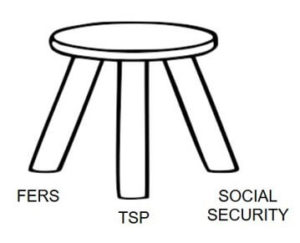

Not so many years ago, financial advisors viewed retirement planning as a 3-legged stool. The first leg was a pension, the second social security and the third being the retiree-to-be’s savings. In the intervening years,… Read More