Unless you are extremely wealthy, there aren’t many tax shelters available to you and healthcare costs are likely a rising concern. For both of those reasons, I am a big fan of Health Savings Accounts… Read More

Unless you are extremely wealthy, there aren’t many tax shelters available to you and healthcare costs are likely a rising concern. For both of those reasons, I am a big fan of Health Savings Accounts… Read More

Stepping in and helping parents with finances can be a challenge. In some instances, the parent needing the help may have managed finances for decades and be reluctant to accept help. At the opposite end… Read More

I was listening to a podcast recently featuring Meir Statman, an academic who has long focused on the field of behavioral finance. While the topic itself was interesting, one thing Statman said that stood out… Read More

If you are a federal employee and are considering early retirement, this article will help you understand your options and how to determine if early retirement is feasible. We’ll examine how your FERS annuity and… Read More

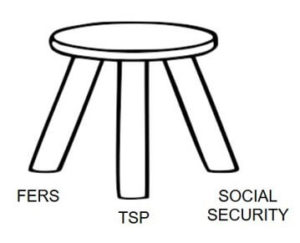

Federal government pensions are really pretty complex because they’ve become progressively less rich. The pensions for federal government employees that were employed before 1987, they had what was known as the CSRS or the Civil… Read More

If you’re a federal employee and are planning on retiring soon, you need to understand when you can and when you should withdraw from your Thrift Savings Account (TSP). In this article you’ll learn about… Read More

One of the questions clients ask most often is whether they should invest in a Roth IRA or Traditional IRA. There is no one right answer – as with most issues in financial planning, it… Read More

Not so many years ago, financial advisors viewed retirement planning as a 3-legged stool. The first leg was a pension, the second social security and the third being the retiree-to-be’s savings. In the intervening years,… Read More

When my aunt founded Minerva nearly 30 years ago, one of the first groups for whom she did a good deal of work were teachers. At the time, the State was looking for assistance with… Read More

In last week’s blog post, I covered what every financial plan should include regardless of whether you were concerned with retirement planning, planning for an inheritance or some other issue. This week, I want to… Read More